As tensions within NATO rise and the U.S. shifts under Trump, Germany's historic defence budget boost signals a bold move towards European military autonomy and economic opportunity.

Germany’s decision to significantly boost its defence budget marks a pivotal moment in European security policy. Long criticized for failing to meet NATO’s 2% GDP defence spending target[1], the country has now committed to a more robust military investment strategy. This shift, largely spurred by Russia’s 2022 invasion of Ukraine and evolving geopolitical threats, reflects Germany’s increasing role in NATO and European defence. As NATO’s largest European economy and second-largest member after the United States, Germany’s defence strategy carries considerable weight within the alliance.

The latest budget under Chancellor Friedrich Merz introduced substantial reforms, including new financing mechanisms that ensure long-term sustainability for military expenditures. These changes not only reshape Germany’s national security strategy but also have far-reaching implications for NATO and the broader European security landscape, particularly as Europe seeks greater strategic autonomy amid uncertainties surrounding U.S. commitments to the alliance.

Background: Germany’s Reluctance and Changing Priorities

For decades, Germany maintained a cautious approach to defence spending, shaped by fiscal conservatism and historical sensitivities. Post-World War II pacifism, combined with stringent debt rules, contributed to a defence budget that consistently fell short of NATO’s 2% GDP benchmark.

Following Russia’s invasion of Ukraine in 2022, then-Chancellor Olaf Scholz announced a historic €100 billion special fund to modernize the German military[2]. This fund, meant to be used from 2022 to 2027, was a direct response to heightened security threats in Europe. While this move helped Germany temporarily reach NATO’s spending target, concerns loomed over the sustainability of defence financing beyond 2027.

The 2025 Budget: A Structural Overhaul

The German parliament, led by Friedrich Merz and the Christian Democratic Union (CDU), has approved a groundbreaking spending package. This package introduces a fundamental shift in Defence financing by exempting military spending above 1% of GDP from the constitutional debt brake[3], a rule that limits new government borrowing to 0.35% of GDP.

With Germany’s 2024 GDP estimated at €4,305 billion (approximately USD 4.6 trillion), 1% equates to roughly €43 billion. By allowing additional Defence spending beyond this threshold to be borrowed without affecting deficit limits, the government ensures that Germany can maintain NATO’s 2% GDP spending target in the long term.

The U.S. Under Trump: A Complicating Factor for NATO

The timing of Germany’s Defence spending surge is not coincidental. In January 2025, when Donald Trump reclaimed the U.S. presidency, NATO faced an unprecedented challenge. Trump’s skepticism toward NATO and his rhetoric regarding Defence spending strained relations within the alliance. Trump’s demand that NATO allies, including Germany, increase Defence spending beyond the 2% target—potentially as high as 5% [4]—created further tension. His administration also signaled a willingness to scale back U.S. military commitments, undermining NATO’s credibility. These moves, alongside his controversial admiration for Russian President Vladimir Putin, have left NATO allies like Germany scrambling to secure their Defence capabilities.

In response, Germany accelerated its Defence spending overhaul. The increased commitment to Defence, alongside Chancellor Merz’s call for Europe to bolster its Defences, highlights the growing realization that NATO may no longer be able to rely solely on U.S. military power. The shift in U.S. policy under Trump has underscored Europe’s need to take more responsibility for its security.

Beyond Defence: Infrastructure and Economic Growth

Alongside Defence spending, the CDU-led government has also announced a €500 billion infrastructure fund spanning 12 years. This investment aims to modernize transportation, digital networks, and energy infrastructure, fostering economic growth and resilience. The combination of Defence and infrastructure spending reflects a broader strategy to enhance Germany’s long-term economic and security stability.

Improving infrastructure is critical for military logistics as well. The investment will address past logistical shortcomings that have hindered NATO’s rapid deployment capabilities in Europe. Germany’s new commitment ensures that troops and equipment can efficiently reach NATO’s eastern flank, strengthening collective deterrence.

Public Sentiment and Political Challenges

Despite the strategic importance of these reforms, domestic challenges remain. Public opinion on military spending is divided, with many Germans concerned about potential trade-offs, such as higher taxes or reductions in social programs. The partial rollback of the debt brake has sparked debate among fiscal conservatives and opposition parties, who warn of the risks associated with increased borrowing.

Moreover, bureaucratic inefficiencies in Germany’s Defence procurement system have raised concerns over whether the funds will translate into real military capabilities. Germany’s previous Defence modernization efforts have faced delays and cost overruns, leading some analysts to question whether the new spending plan will achieve its intended results.

“Budgeting for Growth, Not Jobs”

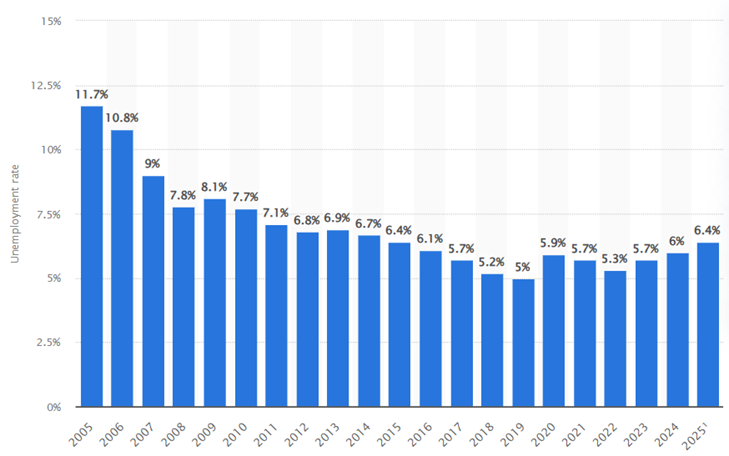

Germany’s unemployment rate climbed to 6.3% in March 2025, with approximately 2.92 million individuals out of work, signalling growing strain in the labour market amid a broader economic slowdown. Despite these warning signs, the 2025 federal budget, finalized after intense coalition negotiations and shaped by the constraints of the constitutional “debt brake”, prioritizes fiscal consolidation, defence spending, and long-term economic competitiveness over immediate labour market interventions.

Limited Focus on Job Creation

At the heart of the budget is a 49-measure “growth initiative” aimed at stimulating investment and competitiveness. This includes business tax relief, such as preventing bracket creep and introducing new depreciation incentives, along with efforts to reduce bureaucracy. While these policies are designed to attract private-sector investment, they offer only indirect and long-term benefits for employment, lacking targeted programs to address the current unemployment crisis or the anticipated rise past 3 million jobless—a level not seen in over a decade.

Public investment is set to increase to €57 billion, supported by an additional €40 billion from the Climate and Transformation Fund. However, these funds are largely earmarked for infrastructure projects—including €15.1 billion for rail modernization—and climate-related initiatives, which may create jobs over time but fall short of delivering short-term employment relief.[6]

Social Support Falls Behind

Despite the uptick in joblessness, the budget freezes increases to Bürgergeld, Germany’s primary unemployment assistance program, citing lower-than-expected inflation. Labour Minister Hubertus Heil defended the decision, but critics argue it fails to address the real financial strain on jobless individuals, especially in the wake of the energy crisis and weakened economic momentum. Without benefit adjustments, the purchasing power of the unemployed is eroded, threatening domestic demand—a key component of the government’s projected 0.7% GDP growth in 2025.

Labour Market Policies Miss the Mark

The budget includes several labour market incentives: tax exemptions for overtime pay, programs encouraging older workers to remain in the workforce, and tax breaks for skilled foreign workers (with 30%, 20%, and 10% of gross salary exempted over three years)[7]. However, these measures largely benefit those already employed or entering the workforce while overlooking the 2.92 million currently unemployed, many of whom lack the skills demanded by Germany’s evolving industrial and technological sectors.

The absence of substantial retraining or upskilling initiatives highlights a disconnect between the budget’s labour policies and the realities of the job market, where automation, green energy transitions, and demographic shifts continue to reshape employment needs.

Germany's labour market also grapples with structural issues, including a shortage of skilled workers and a sluggish manufacturing sector, impacted by global trade frictions and elevated energy prices.

Structural Challenges Unaddressed

Germany’s labour market also grapples with structural issues, including a shortage of skilled workers and a sluggish manufacturing sector, impacted by global trade frictions and elevated energy prices. The budget, which totals €488 billion and reduces the deficit to 2.0% of GDP, adheres strictly to the debt brake, limiting the state’s fiscal capacity to confront these deeper challenges.

Critics, such as the Rosa Luxemburg Foundation, argue that this commitment to fiscal discipline is ideologically driven, prioritizing debt control over responsive social and economic policy. In particular, Finance Minister Christian Lindner has pushed back against calls from more interventionist voices within the coalition—such as the Greens—who advocate for more aggressive labour market investments.

Missed Opportunities for Fiscal Flexibility

With a debt-to-GDP ratio expected to stabilize at 63% and Germany’s continued status as a safe-haven borrower, many economists believe the country has room to manoeuvre. Yet, instead of utilizing this fiscal space to expand labour market programs, the coalition opted to reduce the deficit from €17 billion to €12 billion, underscoring a preference for budgetary restraint over comprehensive unemployment solutions.[8]

This renewed focus on defence comes at a time when unemployment is rising - reaching 6.3% in March 2025 - raising concerns that domestic labour market challenges are being overshadowed by strategic priorities.

Implications for NATO and European Defence

Germany’s increased Defence commitment carries substantial implications for NATO. By securing a long-term mechanism to fund military expenditures, Germany strengthens the alliance’s collective Defence posture at a time of rising geopolitical uncertainty. This move aligns with growing concerns over potential shifts in U.S. foreign policy under a possible second Trump administration, where American commitments to NATO may become less predictable.

“We have to readjust our threat perception and take our security in our hands,” said Thomas Silberhorn, a Bundestag member from the center-right CDU[5]

Germany’s budgetary reforms may also set a precedent for other European nations, encouraging increased self-reliance in Defence. With NATO’s European members facing pressure to contribute more to their security, Berlin’s leadership could spur similar moves across the continent.

Beyond NATO, Germany’s strategic pivot could redefine European Defence policy. As the European Union debates further integration of Defence capabilities, Berlin’s willingness to increase spending may catalyze broader EU military collaboration. The shift also reassures Eastern European nations, such as Poland and the Baltic states, which have long urged Germany to take a more assertive role in regional security.

Economic Implications for India

Germany’s massive Defence spending push is also influencing global markets, including India’s Defence and shipbuilding sectors. On the day following the German Parliament’s approval of this unprecedented expenditure, Indian Defence stocks surged significantly. Garden Reach Shipbuilders and Engineers jumped 20%, while Ideaforge Technology and Mazagaon Dock Shipbuilders surged over 10%. Cochin Shipyard rose 8.9%, and Mishra Dhatu Nigam and Bharat Dynamics gained 8.4% and 6.4%, respectively. Paras Defence & Space Technologies moved 6.2%, while DCX Systems and Hindustan Aeronautics rose over 4% each.

Analysts attribute this price spike to market sentiment and growing investor optimism regarding India’s role in the global Defence supply chain. “Defence stocks were hit the most in the recent fall, and now, opportunistic money is chasing these stocks because this sector is expected to be a leader in a market recovery,” said Vinit Bolinjkar, Head of Research at Ventura Securities.[9]

India must keenly watch Germany’s recalibration, not just as a trade partner but as a fellow Indo-Pacific stakeholder and strategic actor.

Moreover, with Europe’s Defence spending projected to surpass $800 billion in the coming years, India has an opportunity to boost its exports of military equipment. As part of its ‘Make in India’ initiative, the Indian government has been actively promoting domestic Defence manufacturing and exports. Germany’s heightened demand for military hardware, along with its NATO allies, could open doors for Indian firms specializing in Defence electronics, shipbuilding, and aerospace components.

Beyond stocks, this shift could lead to deeper Indo-German Defence collaborations, joint ventures, and technology transfers. As India continues expanding its strategic partnerships, increased engagement with Germany’s Defence sector could enhance India’s standing as a key supplier in the global arms market.

Conclusion: A New Era for German Defence Policy

Germany’s latest budget marks a decisive shift in both its defence and fiscal policy, lifting long-standing financial constraints to ensure sustained NATO compliance and solidify its role as a central force in European security. In an era of shifting global dynamics and potential changes in U.S. leadership, this proactive stance strengthens the transatlantic alliance and signals the end of Germany’s traditional reluctance to invest in military capability.

However, this renewed focus on defence comes at a time when unemployment is rising – reaching 6.3% in March 2025 – raising concerns that domestic labour market challenges are being overshadowed by strategic priorities. The long-term success of Germany’s new direction will depend not only on the effective execution of its security commitments but also on its ability to balance external ambitions with internal socioeconomic stability. One thing is clear: Germany is stepping into a leadership role, bolstering European autonomy while generating ripple effects across the global defence industry, including key partners like India.

References:

- [1] https://www.nato.int/cps/en/natohq/topics_49198.htm

- [2] https://www.bundesregierung.de/breg-en/federal-government/special-fund-federal-armed-forces-2047910

- [3] https://www.nytimes.com/2025/03/18/world/europe/germany-debt-brake.html

- [4] https://foreignpolicy.com/2025/03/06/nato-5-percent-defense-spending-trump-russia-ukraine/

- [5] https://www.dw.com/en/germanys-bundestag-votes-in-favor-of-reforming-debt-brake/live-71956815

- [6] https://www.bundesregierung.de/breg-en/news/2025-budget-growth-initiative-2299754

- [7] https://www.dw.com/en/eu-countries-offering-tax-relief-to-foreign-skilled-workers/a-69706130

- [8] https://www.reuters.com/markets/europe/german-government-reaches-agreement-2025-budget-spokesperson-says-2024-08-16/

- [9] https://economictimes.indiatimes.com/markets/stocks/news/germanys-big-military-plans-fire-up-indian-defence-stocks/articleshow/119232467.cms?from=mdr

Sughosh Joshi is a CA Finalist and B.Com graduate with a strong interest in economics, geopolitics, and the analysis of international affairs, particularly those impacting India. Views expressed are the author’s own.