The Chip Alliance will strengthen the supply chains and guard them against geopolitical upheavals and also make India an attractive destination for investment in essential areas.

The collaboration between Foxconn and Vedanta Semiconductor to produce chips in India has been called off due to delays in materializing the agreement. However, both companies are now seeking alternative partners for future endeavours.

Vedanta stated that they possess a production-grade 40 nm technology license from a leading Integrated Device Manufacturer (IDM) and plan to acquire a license for production-grade 28 nm as well. Meanwhile, Foxconn is in discussions with Taiwan Semiconductor Manufacturing Co (TSMC) and Japan’s TMH Group for a joint venture and technology cooperation to establish semiconductor fab facilities in India. Both companies lacked chip manufacturing expertise and intend to announce new partners soon.

The proposed semiconductor plant was set to be built in the Dholera Special Investment Region, in line with the ‘Gujarat Semiconductor Policy 2022-27.’ Gujarat aims to transform the region into an Electronics System Design & Manufacturing (ESDM) ecosystem and offers significant incentives on power, water, and land costs to promote this initiative.

The Indian government launched the ‘India Semiconductor Mission’ worth $10 billion in 2021, aiming to turn Dholera SIR into a ‘Semicon City.’ Additionally, the Production Linked Incentive (PLI) scheme for the electronics sector offers a $1.7 billion incentive package to companies establishing semiconductor manufacturing facilities, with a focus on creating 200,000 job opportunities in five years.

During Prime Minister Narendra Modi’s recent visit to the United States, both countries formed a collaborative mechanism to enhance semiconductor supply chains and boost resilience. Micron Technology pledged an $800 million investment in Gujarat for a semiconductor assembly and testing facility. Moreover, Applied Materials plans to open a collaborative engineering centre in Bengaluru with headquarters in Silicon Valley, while Lam Research Corporation intends to train up to 60,000 Indian engineers in nanotechnologies over the next decade.

The US Semiconductor Industry Association and India Electronics Semiconductor Association (IESA) conducted an interim readiness assessment to identify immediate industry opportunities and support long-term strategic development in complementary semiconductor ecosystems. In addition, SK Hynix, a South Korean chipmaker, is exploring the possibility of establishing a packaging plant in India while evaluating the semiconductor manufacturing incentive program.

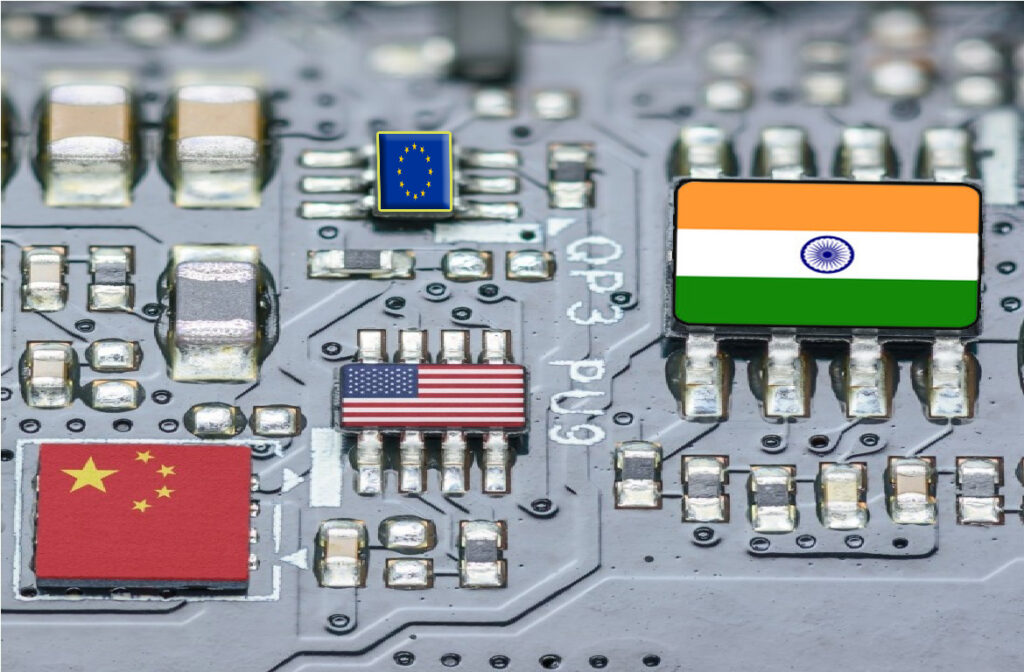

All these developments highlight India’s growing importance as a partner in the current ‘Chip alliance’ of the United States, the Netherlands, Japan, Taiwan, and South Korea. The alliance aims to enhance the ‘security’ and ‘resilience’ of semiconductor supply chains, reducing the world’s reliance on Chinese chips.

India’s role as a top investment destination for critical industries has been further reinforced by the Indo-Pacific economic framework of economic cooperation developed during the QUAD summit, fostering a supply chain network among its participants and making India more attractive for investment in essential areas.

(The author is a Post Graduate student in International Relations at Amity University, Raipur. She writes articles and research papers regularly on international affairs and geopolitics.)