- Once best known for its graphics cards powering video games, Nvidia has become the undisputed leader in artificial intelligence (AI) hardware.

- Nvidia’s advanced GPUs (graphics processing units) now underpin everything from OpenAI’s large language models to autonomous driving systems and military simulations.

- This dynamic is reminiscent of the Cold War’s technology race, where both blocs indulged in self-reliance while keeping track of competitor breakthroughs.

- Any Chinese military move against Taiwan would be a disaster—not only for Nvidia but for the world economy.

Introduction

Few companies embody the intersection of cutting-edge technology and global politics as vividly as Nvidia. Once best known for its graphics cards powering video games, Nvidia has become the undisputed leader in artificial intelligence (AI) hardware. Its advanced GPUs (graphics processing units) now underpin everything from OpenAI’s large language models to autonomous driving systems and military simulations.

But as its market value has raced above the trillion-dollar threshold, Nvidia is a more geopolitically charged company than a traditional tech firm. At the centre of U.S.–China rivalry, supply chain vulnerability, and national security interests, Nvidia shows how semiconductors—the “new oil” of the information economy—are not only business products but strategic resources. The chip world is bifurcating into competing blocs, and Nvidia is in the middle of that crack.

The Rise of Nvidia: From Gaming to AI Supremacy

Nvidia’s strength rests in its CUDA software stack and parallel-processing-optimised GPUs. Unlike sequential-domain CPUs, which execute one task at a time, the GPU crunches out thousands of operations at once, and they are critical for machine learning and generative AI.

By 2023–2024, cloud behemoths such as Microsoft, Amazon, and Google were competing to get inventory for Nvidia’s top-of-the-line H100 and A100 chips, and startups like Anthropic and Inflexion shelled out hundreds of millions on Nvidia clusters, essentially staking their futures on it.

This exponential growth carried Nvidia to the top echelons of the world’s most valuable companies, eclipsing even Saudi Aramco at times—a symbolic reminder that chips, not oil, power today’s economies. But while as much as markets drive Nvidia, geopolitics increasingly determine its destiny.

U.S. Export Controls and the Politics of AI Chips

The Biden administration has also made export controls on high-performance semiconductors, with particular focus on sales to China, more stringent. In 2022, Washington banned Nvidia from exporting its A100 and H100 chips to China unless licensed. Nvidia reacted by creating altered chips—the A800 and H800—knowingly performing insufficiently enough to be below U.S. regulatory levels but sufficiently appealing to Chinese purchasers.

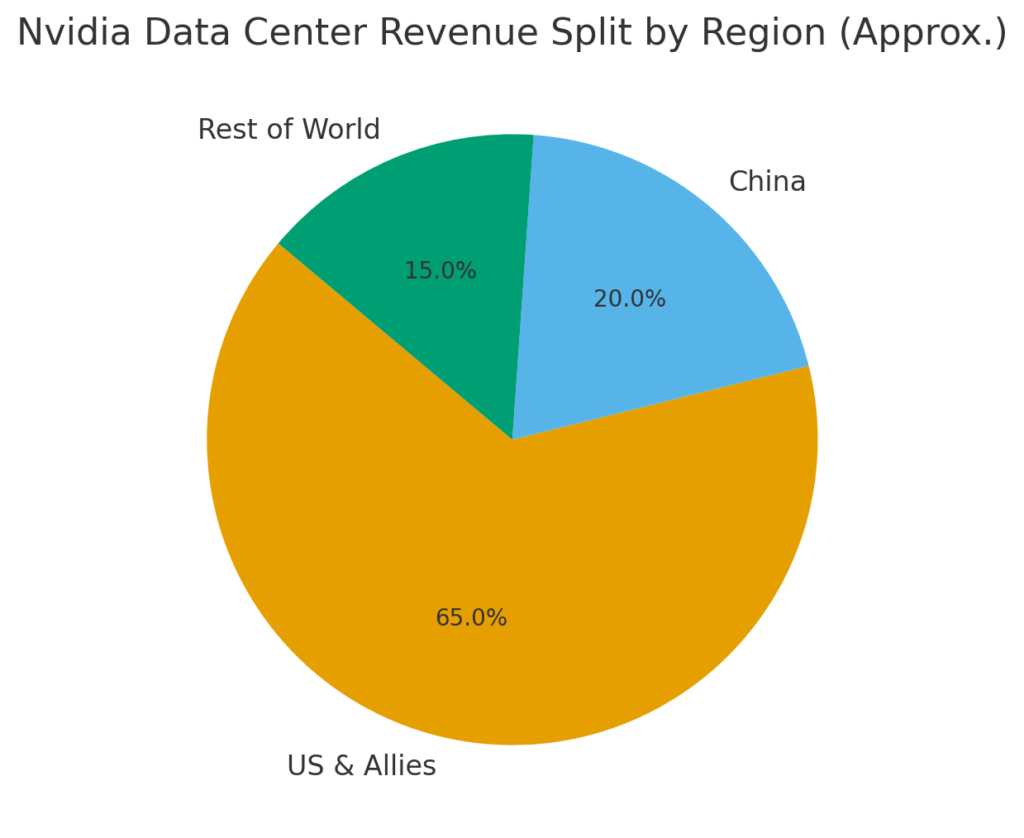

This regulatory back-and-forth reflects the geopolitical interconnectedness: Washington desires to starve Beijing of access to cutting-edge AI hardware, worried it would speed up military AI usages, ranging from hypersonic missile design to surveillance systems. But fully disconnecting China threatens to cost Nvidia enormous amounts of revenue, as China contributes close to 20–25% of its data centre business.

The balancing act has been “controlled sales.” Some exports are approved by U.S. regulators under licensing, weighing national security against business realities. Nvidia’s quarterly earnings reports now have a new context: not only market demand but the moving line of Washington’s export restrictions.

The chip world is bifurcating into competing blocs, and Nvidia is in the middle of that crack.

China’s Push for Local Alternatives

For Beijing, Nvidia’s dominance is a weakness. China’s aspirations for AI—from its “national champions” of Baidu and Tencent to state-led military uses—hinge on the availability of Nvidia’s hardware. Forced to go without the latest chips, China has ramped up investments in local alternatives.

Huawei (with its Ascend processors) and Biren Technology are among the companies that are creating local GPUs. The government has invested billions of dollars in the semiconductor industry, creating the “Big Fund” to support local champions at a subsidised level. Though there is improvement, local chips remain multiple generations behind Nvidia’s industry-leading offerings.

Nevertheless, China has the advantage of its huge domestic market: AI companies will experiment, improve, and ultimately catch up with local ecosystems. Meanwhile, workarounds—like purchasing Nvidia chips via third-party nations or “grey markets”—exist, foiling Washington’s efforts at air-tight controls.

This dynamic is reminiscent of the Cold War’s technology race, where both blocs indulged in self-reliance while keeping track of competitor breakthroughs. Nvidia, ironically, benefits both sides—providing U.S. allies in volume while maintaining limited (licensed) access to China.

Ukraine’s Neon Gas and the Hidden Fragility of Chip Supply

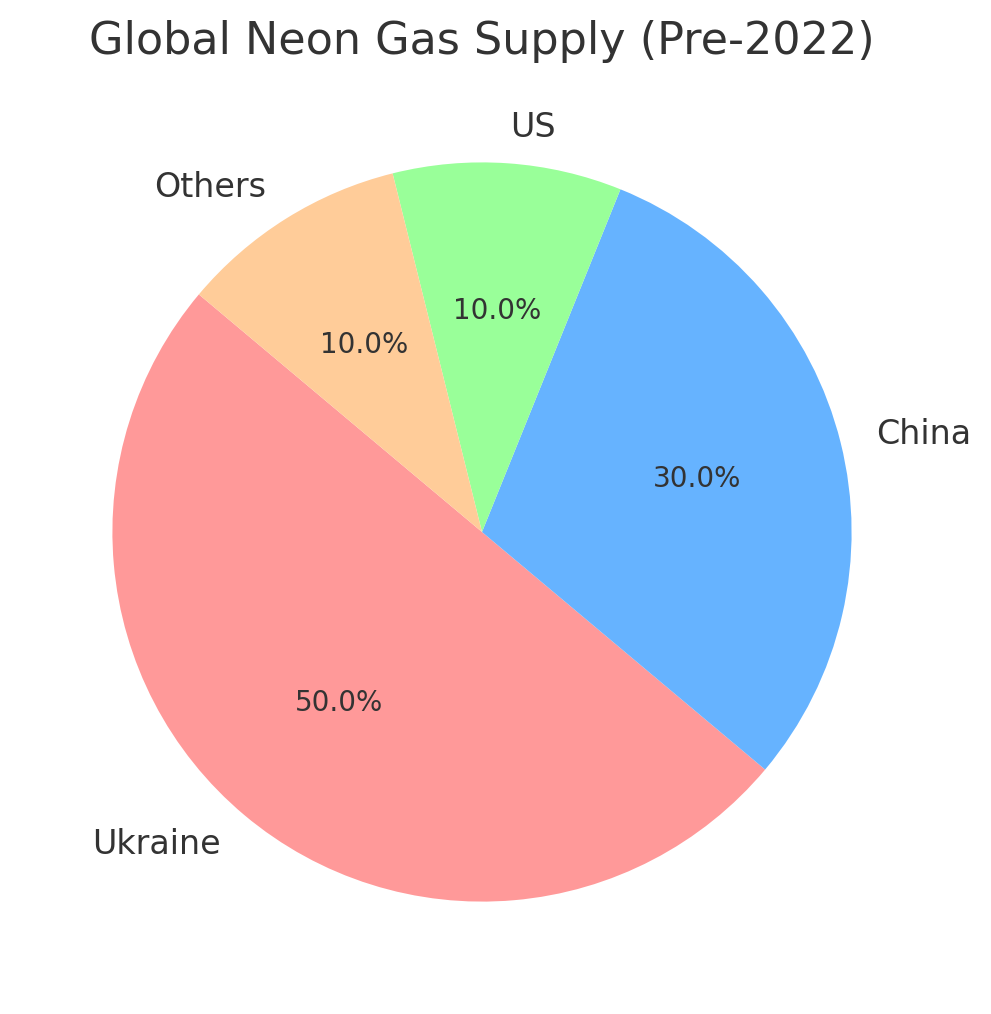

The Russia–Ukraine conflict has also spotlighted another, lower-profile level of chip geopolitics: raw materials. Ukraine was the world’s leading producer of purified neon gas, a vital ingredient in the lasers that are utilised in semiconductor lithography. Before 2022, it had produced more than 50% of all global neon.

When Russia started its special military operation, Ukrainian producers such as Ingas (Mariupol) and Cryoin (Odesa) shut down production. This temporarily disrupted the global chip supply chain, contributing to already-existing pandemic-era bottlenecks. While other manufacturers in the U.S. and China increased output to bridge the gap, the crisis highlighted how vulnerable semiconductor supply chains are.

For Nvidia, whose products depend on sophisticated manufacturing by Taiwan Semiconductor Manufacturing Company (TSMC), any disruption in upstream raw materials, or geopolitical hotspots such as Taiwan itself, is an existential threat. The firm’s dependence on TSMC for production leaves it at the mercy of U.S.–China–Taiwan tensions, further rooting it in geopolitical risk.

Semiconductor Blocs: U.S.-led vs. China-led

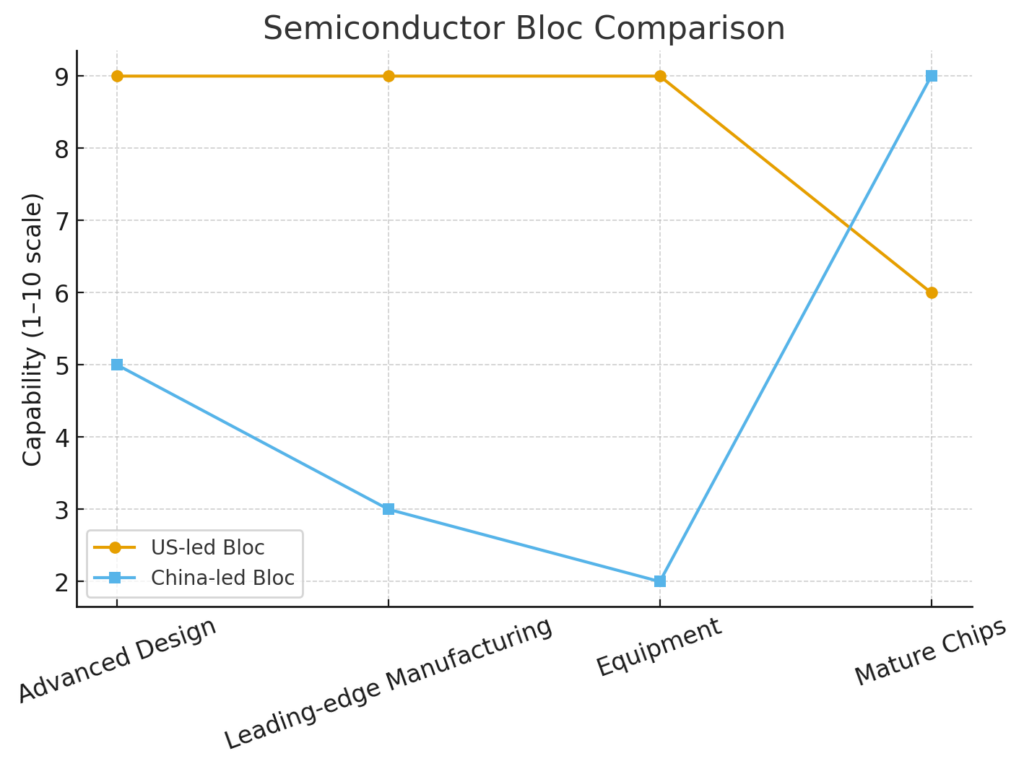

The semiconductor sector is increasingly dividing into two blocs:

- U.S.-led bloc: With the U.S. at the anchor, Taiwan, South Korea, Japan, and Europe. The bloc controls cutting-edge semiconductor design (Nvidia, AMD, Intel), leading-edge manufacturing (TSMC, Samsung), and key equipment (ASML’s EUV tools). Washington has encouraged this network with the CHIPS and Science Act, investing $52 billion in homegrown semiconductor manufacturing.

- China-led group: Fueled by Beijing’s drive for autarky. Behind in cutting-edge nodes, China is ahead in mature chips (28nm and greater), which fuel industries ranging from autos to consumer electronics. State subsidies and economies of scale over time may close the gap.

For the time being, Nvidia represents the U.S.-bloc’s technological advantage, but it is also reliant on world demand, including that of China. Its niche position—selling to both sides under U.S. supervision—represents the uncomfortable equilibrium of globalisation in a fragmented age.

The world of semiconductors is splitting, and Nvidia finds itself at the fault line.

The Taiwan Factor

No discussion of Nvidia’s geopolitical risk is ever complete without Taiwan. TSMC produces Nvidia’s most cutting-edge chips, such as the H100, with its 5nm and 4nm processes. Any Chinese military move against Taiwan would be a disaster—not only for Nvidia but for the world economy.

A blockade or war would deny the world access to frontier-edge semiconductors, disabling industries ranging from defence to AI to consumer electronics. This “silicon shield” somewhat discourages Beijing because destroying Taiwan’s fabs would hurt China just as much as the West. Nevertheless, the threat is a shadow on the future of Nvidia.

The Emergence of Tech Nationalism

The chip war is part of a larger trend toward tech nationalism: the belief that countries need to own key technologies for security and sovereignty. In this vision, Nvidia’s GPUs are not commodities but strategic resources.

- For America, Nvidia is a crown jewel and a weak spot. Washington sponsors its hegemony but limits where it may sell.

- For China, Nvidia is a necessity to break free.

- For India and Europe, Nvidia stands for the chasm between aspiration and overdependence, inspiring indigenous semiconductor ambitions.

This nationalism breaks with the previous model of globalisation, under which supply chains stretched across continents and in which efficiency was the sole focus. The new order is resilience, albeit at greater expense.

Nvidia’s Tightrope: Innovation Amid Constraints

In defiance of geopolitical headwinds, Nvidia keeps innovating. It has on its agenda next-generation GPUs (the Blackwell architecture) and deeper entrenchment in AI software ecosystems. But its growth strategy must inelastically respond to changing rules:

- Revenue at risk: Strengthening of U.S. export controls would erase billions from Nvidia’s profits.

- Customer diversification: Nvidia approaches U.S. allies such as Japan, India, and the EU as substitute growth markets.

- Partnerships: Relationships with cloud vendors and governments assist in integrating its hardware into mission-critical AI infrastructure that is mission-critical.

The company, therefore, treads a fine line—extending technological limits while balancing political red lines.

Conclusion: The Future of Nvidia in a Fractured World

Nvidia’s path is a miniaturised version of the 21st-century semiconductor order. Its GPUs drive the AI revolution, but their sale is under the control of export licenses and geopolitical horse-trading. Its chips are made in Taiwan, a hotspot of great-power competition. Its markets span a world that is more and more divided into tech blocs.

The semiconductor sector, which was once a symbol of globalisation, is today the battlefield of geopolitical rivalries. As America and China compete for the dominance of AI, Nvidia becomes not just a firm but a strategic player—its chips are catalysts for innovation as well as tools of power.

Ultimately, Nvidia might keep driving the AI age, but its destiny will be as much dictated in Silicon Valley boardrooms and Wall Street trading floors as it will be in Washington’s policy circles, Beijing’s industrial planning offices, and the disputed waters of the Taiwan Strait.

The world of semiconductors is splitting, and Nvidia finds itself at the fault line.

Divyanka Tandon holds an M.Tech in Data Analytics from BITS Pilani. With a strong foundation in technology and data interpretation, her work focuses on geopolitical risk analysis and writing articles that make sense of global and national data, trends, and their underlying causes. Views expressed are the author’s own.