- Central Bank Digital Currencies (CBDCs) are one of the most historic monetary policy advances since the gold standard era was abandoned.

- 134 nations are actively exploring CBDCs, which have far-reaching geopolitical implications, capable of upending the dollar hegemony over global trade and cross-border transactions.

- The most important geopolitical aspect of CBDCs is their potential to change cross-border payments.

- CBDCs could be the end of unquestioned dollar hegemony and the start of a multilayered, multipolar monetary order.

Executive Summary

| Central Bank Digital Currencies (CBDCs) are one of the most historic monetary policy advances since the gold standard era was abandoned. In 2024, we are seeing a paradigm shift in global finance, with 134 nations actively exploring CBDCs and several large economies well into sophisticated pilots. This change holds far-reaching geopolitical implications, capable of upending the United States dollar hegemony over global trade and cross-border transactions. The competition to issue and roll out CBDCs has accelerated the competition among big economic powers, with the most notable being China’s e-CNY, which has earned impressive adoption statistics, and non-Chinese efforts such as the European Union’s digital euro initiative. The Indian digital rupee experiment keeps unfolding, while the United States is taking caution in fully issuing CBDCs and exploring its impact on dollar dominance. This report looks at the state of the world on CBDC development now, analyses key pilot programs, and evaluates the possible geopolitical consequences for international monetary arrangements. Important findings indicate that, as adoption levels are still modest today, the trajectory points toward mounting momentum toward the implementation of digital currencies that may fundamentally reshape global financial power relationships. |

Global CBDC Development Status

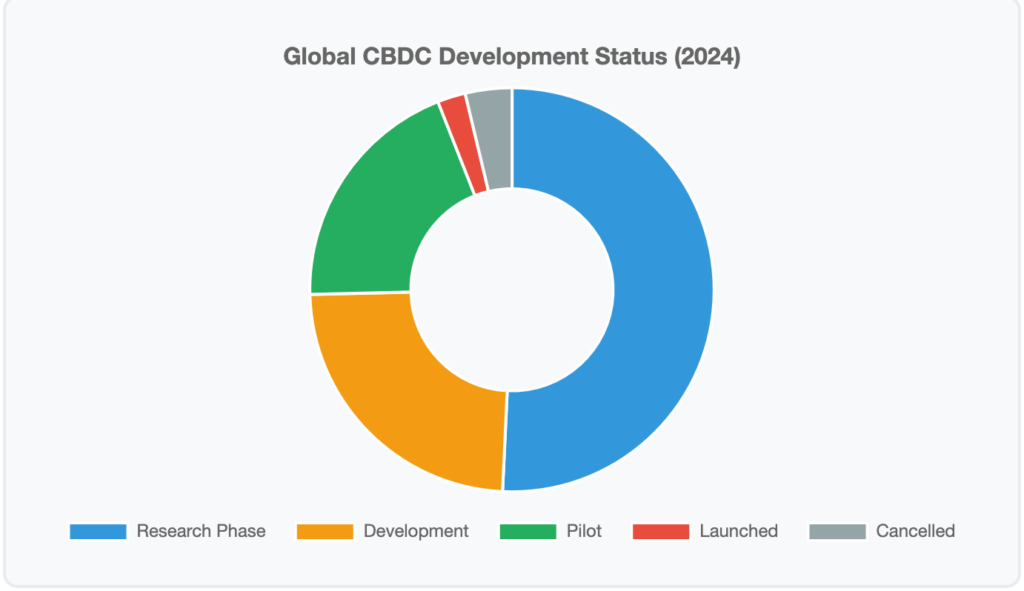

| Development Stage | Number of Countries | Percentage |

| Research Phase | 68 | 51% |

| Development | 32 | 24% |

| Pilot Stage | 26 | 19% |

| Fully Launched | 3 | 2% |

| Cancelled | 5 | 4% |

This is the clear development trajectory from experimental to full-scale implementation, with the Bahamas (Sand Dollar), Jamaica (Jam-Dex) and Nigeria (e-Naira) having fully launched their CBDCs. Adoption has been reportedly low in the systems implemented thus far, with the most successful cases witnessing turnover of less than 1% of the total money supply.

Among G20 countries, 16 are in active CBDC development, and 12 have moved to pilot stages. This is surely a marked acceleration of the pace since 2020, when only 35 countries worldwide were in varying degrees of consideration for CBDC development. This current momentum reflects an increased recognition that digital currencies have a strategic role to play in monetary sovereignty and financial system efficiency.

Key Statistics:

- 134 countries researching CBDCs (up from 35 in 2020)

- 16 G20 countries are in the development phase

- 12 G20 countries conducting pilots

- 3 fully operational CBDCs globally

Major CBDC Pilots: Comparative Analysis

China’s e-CNY: The Global Frontrunner

China’s digital yuan is the most developed and used CBDC in the world. People’s Bank of China’s step-by-step strategy has been very successful, with transactions increasing year on year exponentially. By June 2024, overall volume in transactions was 7 trillion e-CNY ($986 billion) across 17 provincial regions, almost a fourfold rise from the June 2023 figure of 1.8 trillion yuan.

The success of the e-CNY lies in its entry into daily sectors such as education, healthcare, and tourism. The holistic ecosystem strategy has seen organic uptake, albeit that the currency constitutes only 0.16% of China’s M0 money supply as of 2023. The pilot program has spread to major cities like Beijing, Shanghai, and Shenzhen, and has been used in high-profile events such as the 2022 Winter Olympics.

Chart Analysis: China’s e-CNY transaction volume growth shows exponential adoption from 0.1 trillion CNY in Q1 2021 to 7.0 trillion CNY in Q2 2024, demonstrating successful scaling and user acceptance across multiple economic sectors.

India’s Digital Rupee: Measured Progress

From a law and order perspective, India’s perspective towards CBDC administration has been somewhat cautious, with the Reserve Bank of India conducting pilots for both wholesale (CBDC-W) and retail (CBDC-R) applications. With the UPI system already operating at over 10 billion transactions a month, the sale of digital rupees is yet another headache.

Through May 2024, e-rupees worth 3.23 billion were issued into circulation, rising from 1 billion, thereby showing steady growth, albeit on a smaller scale. The RBI’s phased approach will be carried out in partnership with a few major banks and will focus on use cases compatible with existing infrastructures for digital payments so as not to oppose them.

| Country | Launch Date | Current Volume | Coverage |

| China (e-CNY) | 2021 | 7 trillion CNY | 17 provinces |

| India (e₹) | 2022 | 3.23 billion INR | Limited pilot |

| EU (Digital Euro) | 2025 (planned) | Development phase | 27 member states |

European Union’s Digital Euro: Methodical Development

Any promising approach to CBDC construction will follow, check by check, methods learned through experiences of the past with its digital euro project. In January 2024, the ECB launched the draft rulebook and issued the first call for application providers; major resources were set aside for private-sector collaboration.

For the European Union, prioritising privacy, financial stability, and interoperability with existing payment systems is central. In contrast to China, which is fast-tracking the deployment, the ECB is concentrating on concrete regulatory frameworks and a thorough stakeholder consultation before actual implementation. The digital euro installation is henceforth envisaged to be between 2025 and 2026, after regulatory approvals and the successful testing of prototypes.

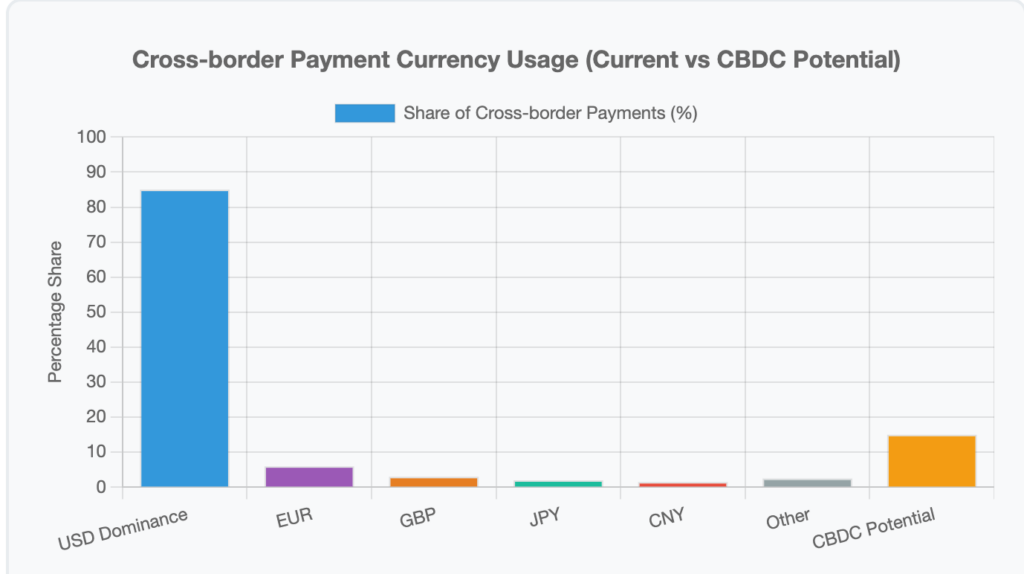

Cross-Border Payment Revolution

The most important geopolitical aspect of CBDCs is their potential to change cross-border payments. At present, traditional international transfers depend almost entirely on the SWIFT network and US dollar intermediation, with the dollar making up 85 per cent of the $7.5 trillion per day foreign exchange market. CBDCs may allow a direct peer-to-peer transaction cross-border without the need for dollar intermediation.

Current Cross-Border Payment Distribution:

- USD Dominance: 85%

- EUR: 6%

- GBP: 3%

- JPY: 2%

- CNY: 1.5%

- Other currencies: 2.5%

- Potential CBDC disruption: 15-20% market share by 2030

Project mBridge: A Paradigm Shift

The Multi-Cbdc Bridge Initiative, Which Involves Central Banks From China, Hong Kong, Thailand, And The United Arab Emirates, Illustrates How CBDCs can Streamline The Process Of Instant Cross-Border Settlements. The Initiative Has Processed More Than $22 Billion In Transactions And Has Invited New Users To Join, Showing Increasing International Interest In An Alternative Payment System To The Dollar.

The Mbridge Initiative Can Be Typified As A Technological Revolution; It Could Completely Change The Way International Payments Are Processed. Since The Platform Permits Participants’ Cbdcs To Be Settled Directly, There Is No Need For Correspondent Banking Relationships, While The Settlement Timeframe Is Reduced From Days To Seconds, All With Considerable Reductions In Fees Or Costs.

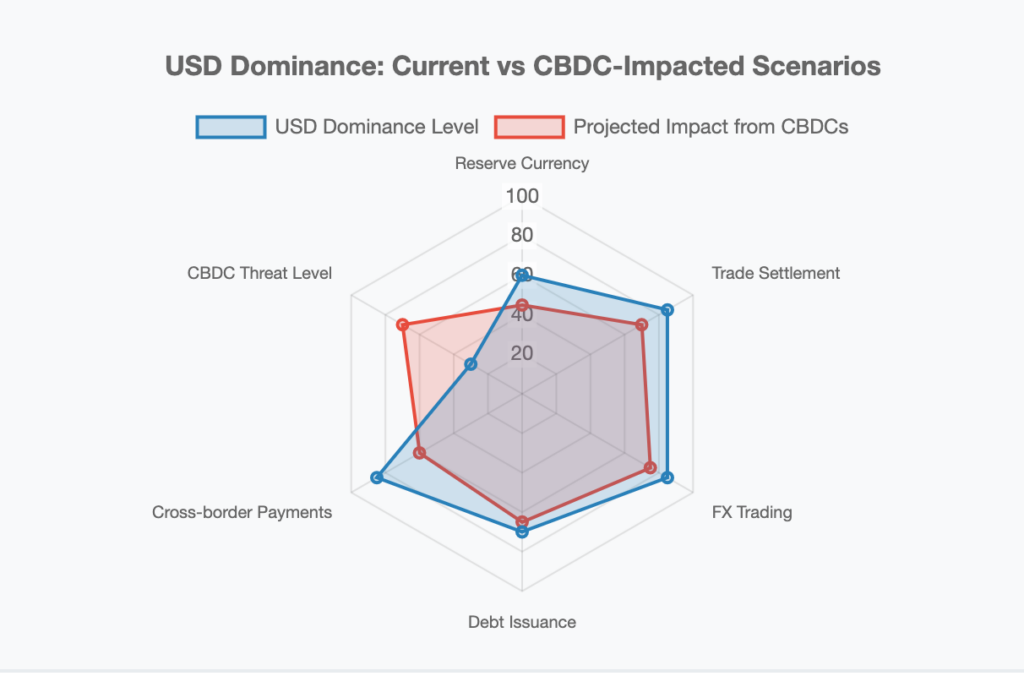

Impact On Dollar Dominance

Any viable trajectory for CBDC development will be face-to-face, learning from experience with the digital euro project. In January 2024, the ECB launched the draft rulebook, and the first call for application providers was issued; substantial resources were allocated for private-sector involvement.

In the EU, preferences for privacy, anonymity, completion, financial stability and existing payment systems all play a prominent role. Contrary to China, which is prioritising the roll-out, the ECB is beginning with concrete regulatory considerations and providing a thorough consultation with stakeholders before establishing real implementation. The virtual euro procedure is now expected to occur only from 2025 to 2026, pending approval and successful testing of prototypes.

Fragmentation Risks and Regional Blocs

Groupings of interoperable CBDCs could strengthen the existing inclination to use local currencies for bilateral trade, but lead to fragmentation of the global financial system into regional blocks. This fragmentation could be rapidly exacerbated by geopolitical tensions or trade disputes that have propelled countries to search for alternatives to dollar-denominated transactions.

BRICS Alternative Payment Systems

The BRICS Cross-Border Payment Initiative (BCBPI) aims to utilise national currencies instead of the US dollar by using the technology of CBDC to facilitate direct settlements. If the initiative is successful, it could process a large amount of trade among BRICS nations (42% of the global population and 23% of global GDP) in the trading of goods and services without requiring dollars.

| Domain | Current USD Share | Projected CBDC Impact |

| Reserve Currency | 60% | 45-50% |

| Trade Settlement | 85% | 70-75% |

| FX Trading | 85% | 75-80% |

| Cross-border Payments | 85% | 60-65% |

China’s Long-term Strategy

The development of China’s e-CNY aligns with its broader goal of creating a multipolar reserve currency system. Adoption of the e-CNY into Belt and Road Initiative projects and potentially requiring Chinese trade settlements could put serious pressure on trading nations to implement interoperable systems, which would build an alternative financial system in the long run.

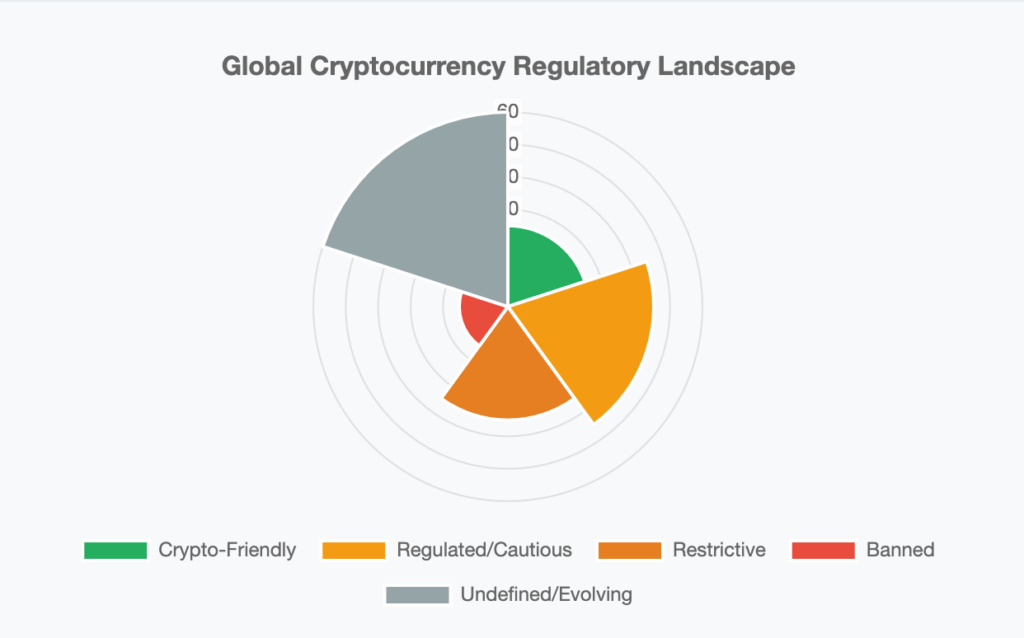

Cryptocurrency Regulation Landscape

Different countries have their own regulatory dealings with cryptocurrencies, creating a complex patchwork with rules emboldened by a legal system across the global digital asset ecosystem. While some countries have embraced crypto innovations, other countries have banned it altogether, and the rest are in regulatory limbo.

Global Cryptocurrency Regulatory Classification:

- Crypto-Friendly: 25 countries (Switzerland, Singapore, UAE)

- Regulated/Cautious: 45 countries (US, EU, Japan)

- Restrictive: 35 countries (South Korea, Turkey)

- Banned: 15 countries (China, India, partial ban)

- Undefined/Evolving: 60 countries

The varying national regulations reflect different philosophical and strategic positions with respect to decentralised digital assets. Countries pursuing CBDCs tend to view cryptocurrencies as competition with their digital currency efforts and, thus, adopt the more restrictive policies. On the other hand, countries without a sophisticated CBDC program may welcome private digital assets while assessing the potential benefits of digitalisation.

Regulatory Trends and Implications

New regulatory developments indicate a pattern towards establishing clarity and working on establishing frameworks rather than outright banning. For example, the European Union’s recently adopted Markets in Crypto-Assets (MiCA) regulation will become effective in 2024 and offers a broad framework that other jurisdictions will look to emulate. The US is also moving forward with clearer regulatory definitions, even as there are existing jurisdictional disputes between agencies.

Future Implications And Strategic Considerations

The implications of adopting CBDCs are not limited only to monetary policy aspects. As digital currencies grow and reach maturity, the potential for various implications for international trade relations, monetary sovereignty, and the global distribution of financial power will likely reshape these aspects. Because of the network effects of payment systems, the first movers and those who achieve critical mass will be able to enjoy durable advantages.

Strategic Questions for 2025 and Beyond

- Will CBDC interoperability standards develop along geopolitical lines, resulting in non-compatible regional systems?

- How will demonstrated financial centres adapt to CBDC-driven disintermediation of traditional banks?

- Can the United States maintain monetary hegemony without the introduction of a competitive CBDC?

- Will regional CBDC blocks accelerate de-dollarisation efforts beyond current bilateral arrangements?

- How will privacy concerns and the surveillance capabilities of CBDCs affect international adoption?

Scenario Analysis

The Tipping Point Scenario

The next two years are poised to be critical in establishing whether CBDCs are an evolution of the dollar-centric system or if they will initiate a revolution towards multiple digital currencies involving the US dollar, digital currencies, and digital assets. The outcome will largely depend on adoption rates, interoperability agreements and geopolitical factors that could precipitate movement away from precedent reserve currencies.

Three broad outcomes emerge from current trends:

- The Status Quo Plus. CBDCs augment the existing US dollar system, but do not move the needle on dollar dominance.

- Regional Fragmentation. Multiple regional CBDC systems emerge along geopolitical lines.

- Multipolar Transition. A gradually diminishing dollar reliance with multiple reserve currency options.

Current indications suggest a likely combination of scenarios 2 and 3 emerges, as regional CBDC systems emerge and eventually interconnect through bridge protocols while diminishing overall reliance on dollar intermediation.

Conclusion

The evolution of central bank digital currencies (CBDCs) signals a dramatic shift in the architecture of global finance, with certain implications transcending technology and monetary policy. Although adoption rates for CBDCs remain modest at present, their growth trajectory alludes to an increased pace of adoption of digital currencies across advanced economies.

It is worth noting the geopolitical aspect of this shift. Adopting CBDCs has the promise of creating more efficient and inclusive financial systems, but disruptive potential in terms of financial fragmentation and power structures can be perceived as risks. Countries and regions that properly navigate this transition, while provoking interoperability and trust, will position themselves at the front of a new digital financial world order.

The significant findings of this assessment are:

- China’s e-CNY has the highest observed adoption level, which potentially makes it a far more dominant alternative than dollars for transactions

- Cross-border CBDC initiatives like Project mBridge, as a dollar alternative payment system, demonstrate the technical feasibility of CBDC systems

- The United States is under strategic pressure to develop competitive CBDC systems while managing risks to its existing financial privilege

- Regional integration of CBDCs could propel the existing de-dollarisation process

- International interoperability standards will likely fracture along geopolitical lines, meaning competing ecosystems for digital currency

In the coming years, tracking CBDC adoption indicators, cross-border integration projects, and regulatory developments will be vital to understanding how this technology will transform global economic relationships. All this is important because the implications are enormous: the choices made over the next several years regarding CBDC design, implementation, and international coordination will influence the global financial landscape for decades.

Organisations and policymakers need to prepare for a world where digital currencies are a more prominent feature of international finance. It could be the end of unquestioned dollar hegemony and the start of a multilayered, multipolar monetary order.

Data Sources:

- Atlantic Council CBDC Tracker

- International Monetary Fund

- Federal Reserve

- European Central Bank

- People’s Bank of China

- Reserve Bank of India

- Bank for International Settlements

- Project mBridge Reports

Divyanka Tandon holds an M.Tech in Data Analytics from BITS Pilani. With a strong foundation in technology and data interpretation, her work focuses on geopolitical risk analysis and writing articles that make sense of global and national data, trends, and their underlying causes. Views expressed are the author’s own.