- Pakistan’s trade deficit is worsening at an accelerated pace and the gap is widening on the monthly basis.

- Data from Pakistan Institute of Development Economics revealed that at least 24 per cent of educated people are jobless at the moment in Pakistan

- For the first time, Pakistan’s total debt and liability crossed 50.5 trillion Pakistani rupees approximately 283 billion USD

- By April 2021, Pakistan’s external debt ballooned to 90.12 billion dollars with Pakistan owing 27.4 per cent of its external debt to China

Back in 2018 with his campaign promising ‘Naya Pakistan’ (New Pakistan) selling his idea of new and prosperous Pakistan, cricketer turned politician Imran khan came to power after a long struggle of two decades. During one of his election campaigns, he promised that he would rather prefer death over the begging bowl and assured that he won’t seek any bailout from the International monetary fund (IMF). Ironically Pakistan recently signed an agreement with IMF for the 6 billion USD package. This was Pakistan’s 13th bailout by IMF since the 1980’s. This was one of the first major setbacks to Imran Khan-led Tehreek-e-Insaaf (PTI) government after coming to the power in 2018.

Pakistan’s economy going through a difficult economic cycle with inflation at its highest level in years and the value of the Pakistan rupee declined by almost 12 per cent from the start of 2021 and more than 17 per cent having bottomed out to 152.50 Pakistan rupee to a dollar in Mid-May making it one of the world’s worst-performing currencies and paved a way to destroy its purchasing power. Today Pakistan’s economy is worth just about 278 billion dollars which is less than the net worth of entrepreneur Elon Musk(1). In comparison, India’s annual budget in FY 2021-22 is around 467 billion.

Pakistan’s trade deficit is worsening at an accelerated pace. Its trade deficit stood at 3.87 billion dollars in October but in November it stood at 5.11 billion dollars showing that the trade gap is widening on the monthly basis. Its foreign reserves are depleting, due to its security concerns, there is zero foreign direct investment coming in forcing it to borrow loans from other nations and financial institutions at the higher rate of interest.

According to the Pakistan Bureau of Statistics, the Consumer Price Index (CPI) of Pakistan has been increased to 12.74% in December 2021 which is the highest in the past 21 months(2). This was due to the recent rise in oil prices which was the highest ever in its history and led to an increase in food prices making the cost of living higher for its citizens.

Its foreign reserves are depleting, due to its security concerns, there is zero foreign direct investment coming in forcing it to borrow loans from other nations and financial institutions at the higher rate of interest.

Pakistan’s unemployment is expected to reach 5.1 per cent in 2021 which means that 22 million Pakistanis are unemployed and among them 15 million are under the age of 30. The data revealed by the Pakistan Institute of Development Economics (PIDE) in September 2021, showed that the unemployment rate in Pakistan 16 per cent which contradicted the Imran Khan-led government’s claim of 6.5 per cent. PIDE data highlighted that at least 24 per cent of educated people are jobless at the moment in the country, according to Dawn. The unemployment rates are rising so rapidly that a recent vacancy for the peons post in one of its high courts saw thousands of PhD holders applying for it.(3) When it comes to poverty, official figures from the 2015 show that about 24.5% of Pakistanis live below the poverty line. But IMF has pointed out that owing to the Covid-19 pandemic and slow economic growth, nearly 40 per cent of Pakistan’s population might be under below poverty line.

Recently back in November Pakistan prime minister, Imran Khan said that the “Biggest problem” is that its government doesn’t have enough money to run the country due to which they have to borrow loans. He even added that the rising foreign debts and low tax revenue had become an issue of “national security”. For the first time, Pakistan’s total debt and liability crossed 50.5 trillion Pakistani rupees approximately 283 billion USD of which an additional 20.7 trillion Pakistan rupee loan was taken under the current government alone as per the state bank of Pakistan data. Almost 60 per cent of Pakistan’s GDP is used to pay interest on its debt if we calculated it on the daily basis then the Imran khan government has borrowed 187 million dollars on daily basis.(4)

The unemployment rates are rising so rapidly that a recent vacancy for the peons post in one of its high courts saw thousands of PhD holders applying for it.

If we look at Pakistan’s history of knocking on IMF’s door, it started back in 1958 when General Ayyub Khan first took the IMF route and signed an agreement to secure special drawing rights (SDR) of 25 million dollars under a standby agreement. In a recent bailout in 2019, Pakistan under Imran Khan received 6 billion dollars. This bailout comes despite Imran khan previously saying not to seek another bailout from IMF, as he targeted alternative funding from the Middle East and China. Till date, IMF has given loans to Pakistan on 22 different occasions. It has borrowed 14.83 billion dollars under special drawing rights (SDR) by IMF. Since its membership, it was bailed out under SDR 13 times.

Pakistan- Saudi relations on the brink

Pakistan and Saudi have maintained a close relationship for decades. During both Pakistan’s military and civilian regime Saudi offered generous economic assistance. The Saudi Kingdom since the 1970s has helped Pakistan economically by pumping money in the forms of investments and other financial aid. However, though the Saudi and Pakistan’s relationship is durable, it has not been unconditional. In 2019, Saudi crown prince Mohammed bin Salman visited Pakistan with a large business delegation that pledged over 20 billion to invest in Pakistan. The pledge of investment however failed to materialise due to Pakistan’s sub-optimal trade and business climate, rampant corruption, procedural bottlenecks, power outages and a long list of deficiencies.

Despite this Saudi Arabia pledged financial assistance with a package including 3 billion dollars in deposit and 1.2 billion to 1.5 billion dollars worth of oil supplies on deferred payments to bail out Pakistan from its never-ending financial crisis. But this loan has been secured under tough conditions where Pakistan will have to repay the money after one year. Saudi Arabia may also demand a refund on a three-day notice period.

China’s Vassal state?

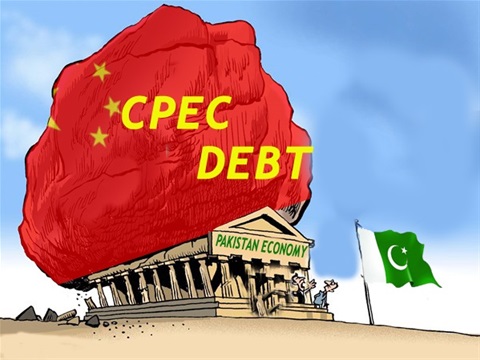

China’s influence on Pakistan’s economy has grown substantially in recent years, mainly because the Communist country is now its largest creditor. According to documents released by Pakistan’s finance ministry, its total public and publicly guaranteed external debt stood at 44.35 billion dollars in June 2013, 9.3 per cent of which was owed to China. By April 2021, this external debt had ballooned to 90.12 billion dollars with Pakistan owing 27.4 per cent – 24.7 billion dollars of its external debt to China, according to figures provided by the IMF.(5)

Recently Pakistan looking forward to securing a 3 billion dollar loan from China during the upcoming visit of Prime Minister Imran Khan to Beijing, participated in the opening ceremony of the Winter Olympics. China has been accused of luring economical weaker countries into high-interest loan deals. As a case in point, Pakistan in FY 21-22 paid over 26 billion Pakistani rupees in interest to China. As per local media reports, Pakistan has been paying foreign debts using Chinese trade finance facility.

China has been accused of luring economical weaker countries into high-interest loan deals. As a case in point, Pakistan in FY 21-22 paid over 26 billion Pakistani rupees in interest to China.

The China-Pakistan economic corridor (CPEC), which aims to connect the Gwadar port in Pakistan’s Baluchistan with China’s Xinjiang province, is a flagship project of China’s ambitious multi-billion-dollar Belt Road Initiative (BRI). According to the United States Institute of Peace, with mounting debt, Pakistan is allowing China to use debt-trap diplomacy to gain access to its strategic assets.

Pakistan is on the verge of economic collapse with it being nearly impossible to pay back its mounting debts. With skyrocketing inflation, rising unemployment and zero foreign direct investment, some critical questions rise as to how Pakistan could tackle this economic collapse. Will it continue to bend the knee for additional loans to pay back the existing ones, or will it bring major changes in its economic policies to rebound from its worst financial crisis?

References:

1. Is world’s richest man Elon Musk’s net worth more than entire GDP of Pakistan? – https://www.dnaindia.com/world/report-is-world-s-richest-man-elon-musk-tesla-spacex-net-worth-more-than-entire-gdp-of-pakistan-find-out-2918181

2. Inflation at its highest in two years https://www.dawn.com/news/1672720

3. Unemployment rate rises relentlessly in Pakistan as 1.5 million people apply for peon’s post https://www.newindianexpress.com/world/2021/sep/28/unemployment-rate-rises-relentlessly-in-pakistan-as-15-million-people-apply-for-peons-post-2364892.html

4. Interest payments consume one-third of Pakistan’s budget https://asia.nikkei.com/Economy/Interest-payments-consume-one-third-of-Pakistan-s-budget

5. China Is Pakistan’s Largest Bilateral Creditor https://www.usip.org/publications/2021/05/pakistans-growing-problem-its-china-economic-corridor

Sourabh Shetty is a partner at Fiscal Focus LLP and a finance executive at Param Foundation. He writes on finance, economy and international affairs. Views expressed are the author’s own.