- United States Geological Survey geological survey estimates that Afghanistan may hold 60 million metric tons of copper, 2.2 billion tons of iron ore, and 1.4 million tons of rare earth elements (REEs) such as lanthanum, cerium, neodymium, and veins of aluminium, gold, silver, zinc, mercury, and lithium.

- The USGS estimates the Khanneshin deposits in Helmand province will yield 1.1.-1.4 million metric tons of REEs. Some reports estimate Afghanistan REE resources are among the largest on earth.

- China has won exploration rights for copper, coal, oil, and lithium deposits across Afghanistan, and there are reports that Beijing won the rights to develop a copper mine by bribing Afghan mining officials.

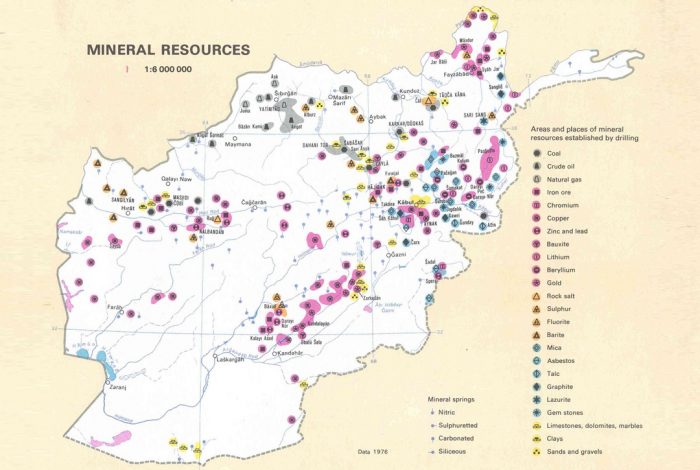

America and NATO Troops are going to withdraw from Afghanistan this year. Soon there may be a power vacuum with lawlessness as Taliban, warlords, and external forces trying to control the land. Afghanistan has over 1,400 mineral fields, containing barite, chromite, coal, copper, gold, iron ore, lead, natural gas, petroleum, precious and semi-precious stones, salt, sulfur, talc, and zinc, among many other minerals. United States Geological Survey (USGS), mapped in broad-scale hyper-spectral data which is highly precise technologies deployed by aircraft concluded that Afghanistan may hold 60 million metric tons of copper, 2.2 billion tons of iron ore, 1.4 million tons of rare earth elements (REEs) such as lanthanum, cerium, neodymium, and veins of aluminium, gold, silver, zinc, mercury, and lithium.

In Ghazni province, the potential for lithium deposits is as large as those of Bolivia, which has the world’s largest known lithium reserves. The USGS estimates the Khanneshin deposits in Helmand province will yield 1.1.-1.4 million metric tons of REEs. Some reports estimate Afghanistan REE resources are among the largest on earth. Even Soviets identified mineral deposits in Afghanistan during their decade-long occupation.

Analyses from the early 1980s suggested that Moscow occupied Afghanistan in part to gain valuable minerals. Journalist Edward Girardet, writing in 1982 for The Christian Science Monitor, argued that “the Soviet Union’s exploitation of Afghanistan’s natural resources has amounted to nothing less than economic pillage.” He estimated that it “contributes heavily toward subsidizing its estimated $3-$4 million a day military occupation costs.” The Soviets focused on copper, natural gas, oil, and uranium, but US-supported insurgents routinely interrupted the work of extracting them. Presently value of resources in Afghanistan is estimated between $1-3 trillion dollars.

Now in 2021 external forces like China wanting to become global powers are seeking raw materials and resources especially rare-earth for next-generation technology. If there is lawlessness and a weak government in Afghanistan from debt trap to assistance the country can be easily targeted. Afghanistan has long been a foreign aid-dependent country touching up to 70%. Due to hostile neighbours, ethnic divisions, insecurity, lack of proper institutions, Afghanistan can lose its resources. Deficient infrastructure makes transport and export difficult. Also, the warlords are a hindrance not only for the Afghan Government but also to the development of resources.

Here comes China which has won exploration rights for copper, coal, oil, and lithium deposits across Afghanistan, and there are reports that Beijing won the rights to develop a copper mine by bribing Afghan mining officials. For China, Afghanistan presents a new opportunity to expand its mining and transportation projects in the Belt and Road initiative. China has already been pursuing strategic partnerships with Iran and maintains $62 billion in investments in the China-Pakistan Economic Corridor. Poor security, lack of proper legal framework and organisational capacity, as well as corruption, have prevented the development of the sector. “

One important factor to notice is an Afghan mining source recently visited the Afghanistan-Pakistan border undercover and witnessed hundreds of trucks carrying illegally obtained coal, talc, and lapis into Pakistan. The coal transport was controlled by Iran-backed Afghan warlords, the same warlords who have formed Afghan Shiite militias that fight in Syria on the side of the Assad regime. The talc is traded and sold by mafia groups tied to Pakistani dealers, but the product is ultimately destined for Europe and the United States.

One can conclude that a peaceful Afghanistan is good for the world and the region. The rise of Taliban, Al Qaeda, ISIS and external forces using Afghanistan as a proxy for their great game can be a curse. Pakistan has tarnished Afghanistan for its own agenda. Now China wants to control the resources and want to fill the vacuum as authoritarian China can easily woo the warlords, insurgents and fundamentalists than the democratic actors who believe in human rights and freedom.

For now, not only their land but also their resources can become a curse and fall to nefarious designs of China. Hence the US and NATO should consult with regional actors like India before complete troop withdrawal and ensure that peace returns in Afghanistan not only to save the government but also its rare resources.

M.AM.PhiL/(PhD SNU South Korea)

Very nice article it is an eye opener which shows how rich Afghanistan is. The continued unrest has simply made the country go backwards. Pakistan and USA are playing a major role in the region either to control or abbet Islamic organizations and now with USA pulling back its troops the taliban will create more unrest. China as usual is in the fore front to exploit opportunities and they will succeed. The question now is where is India we have been helping the afghan government so much but have still failed to capitalize the situation to our advantage. What is wrong with our policy. A serious thought needs to be given where are we failing.

The cause for the entire Afghan-Taliban ordeal