|

Getting your Trinity Audio player ready...

|

The 1918-19 Spanish Flu caused by the H1N1 virus had infected close to one–third of the world population with 50 million deaths and was considered the most devastating pandemic. A century later, the world witnessed another highly infectious pandemic caused by SARS – CoV 2 virus, better known as Covid – 19. India being the second most populous country in the world faced the brunt of Covid – 19. The pandemic highly affected the public health, economy and human psyche of the country (Kaushik, 2020). India reported the first case of Covid-19 on January 30, 2020, and the numbers spiked thereafter. The virus spread through the trade and travel regions linked to the country. The Government of India took a tough and timely decision of closing the international borders and announcing a nationwide lockdown. The country heaped praises from the World Health Organisation for such a hard-hitting decision. Even though the closing down of the economy gave time for the Government to formulate new strategies, there was a spurt in the number of patients and the causal effects of the pandemic reached their peak. The economy was suffering from adverse effects, across all the states, due to inequalities in health, wealth, economic, social and cultural aspects. The sudden imposition of lockdown proved to be a disadvantage to the already vulnerable population. The country faced a mass migration of workers in the informal sector and a huge rise in starvation with congestion in surroundings and insufficient public health conditions (The Lancet, 2020). There was a disruption in non – Covid – 19 health services and the financial assistance and food amenities provided by the administrators were not sufficient for the needy. India has tried its best to cope with the growing number of Covid-19 infections and survive the negative effects on the economy. Among the three aspects of Covid-19 that include: human life, economy and environment, human life and economy got negatively affected to a very great extent while the third aspect provided a positive outcome of a cleaner and healthier environment.

The virus proved detrimental not only to the health of individuals but to the health of the economy. The poor were already affected due to technological advancements replacing unskilled labour and the pandemic added to their woes (Mursheb, 2022). A major share of the population lost their livelihood due to the lockdown.

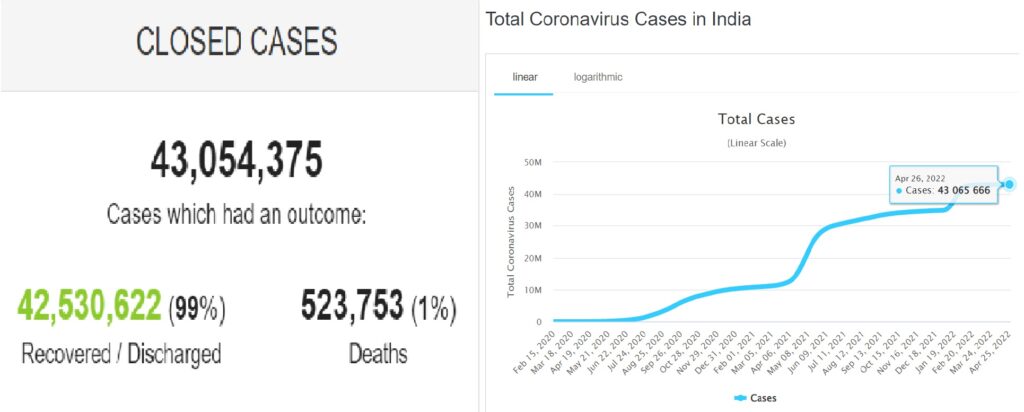

According to the Worldometer information, the following table and graph portray the current scenario of Covid-19 cases on date:

The fiscal impact of the pandemic was extensive and affected various sectors of the economy. From a financial standpoint, the closure of business units and travel restrictions have adversely affected productivity and in turn employment. The Government had to balance the trade, exchange rate and interest rate fluctuations along with the financial market inefficiencies (Sharma and Sharma, 2020).

The causal effects of Covid-19 increased the various forms of inequality like wealth and income. Inequality is multi-dimensional and concerns various aspects like income, wealth, education, etc. Different measures of Inequality such as the Gini Coefficient, The Theil Index and the Income Share of the wealthiest in the society are sensitive to different parts of the distribution and can in principle rank inequality before and after the pandemic differently. “All metrics are not equal when it comes to assessing the pandemic’s unequal effect” (International Monetary Fund, 2021).

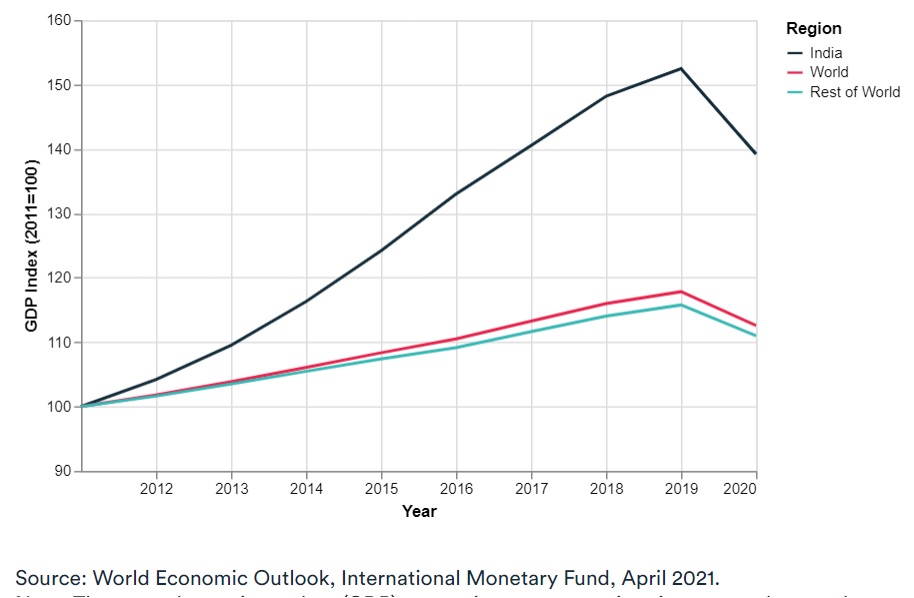

After attaining independence, India’s National Income decreased in 1958, 1966 and 1973, however, 1980 saw a record decline of 5.2%. GDP Rate has been on a downward trajectory from 2015 -16 (Dev and Sengupta, 2020). However, the year 2020 proved to be the most unfavourable ever in the country’s history concerning economic contractions. The IMF Report (April 2021) states that India’s GDP fell by a colossal 24.4% from April to June 2020 and the overall rate of contraction from 2020 to 2021 was 7.3%.

This decline can be attributed to the reversal of the trend in economic inequality (International Monetary Fund, 2021 as stated by Deaton, 2021).

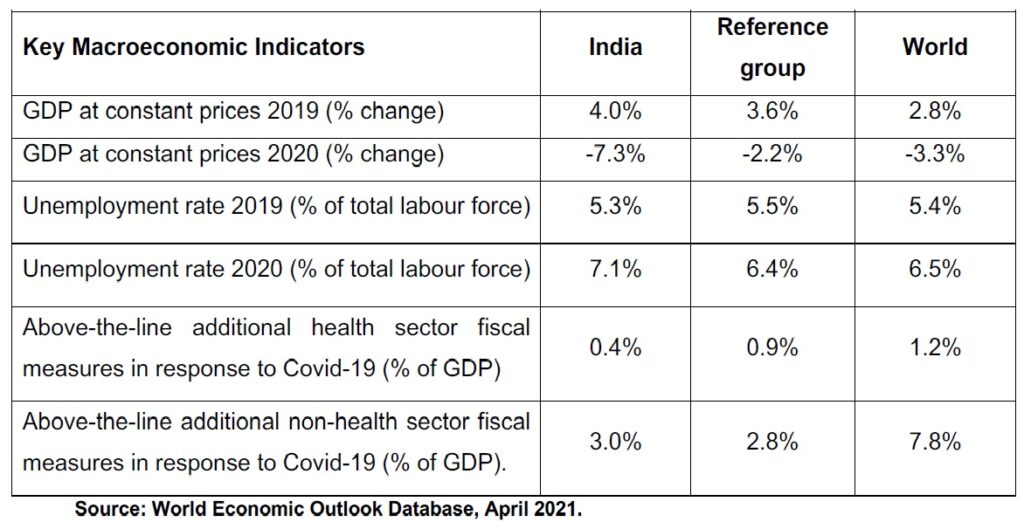

The above table of key macroeconomic indicators indicates that India was affected by one of the major contractions for GDP and Unemployment. In the pandemic year 2020, 42.5% of the total wealth was held by the top 1% of the population, while only 2.5% of the total wealth was held by the bottom 50% (Oxfam, 2020 as stated in Dhingra and Ghatak, 2021). The number of people below the poverty line in India had multiplied post-pandemic and the number of middle-class people had reduced to one–third.

Branko Milanovic named the distribution of GDP per capita among countries as “Concept 1 Global Inequality”. Nobel Laureate Angus Deaton (2002), in a recent research paper, shows that on average, richer countries also experience larger economic contractions than poorer countries in 2020 due to the pandemic.

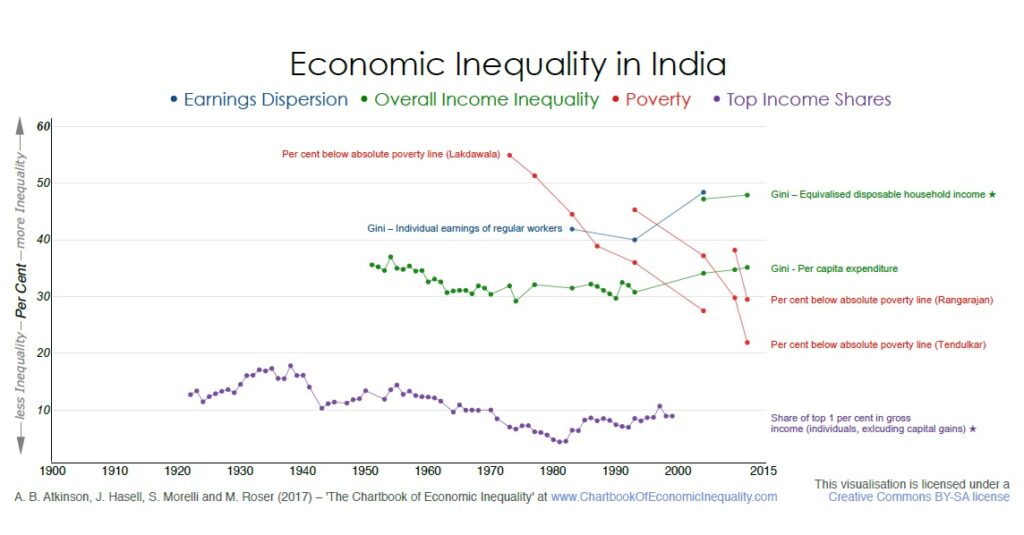

The chartbook of Economic Inequality uses five indicators such as Overall Income Inequality, Top Income Shares, Income or Consumption based on Poverty Measures, Dispersion of Individual Earnings and Top Wealth Shares or Wealth Inequality Measures.

Overall Income Inequality refers to the weighted distribution of equivalised disposable income of a household which includes income from all sources less all payments like taxes. Top Incomes Shares is the gross income after deducting the progressive taxes but before the deduction of allowable outgoings. Income or Consumption based on Poverty Measures refers to the figures related to absolute poverty measures based on a poverty line fixed over time in terms of purchasing power. Dispersion of Individual Earnings refers to the wage and salary received by those in employment and whose employment was not affected by absence. Wealth Inequality Measures refers to the net worth of either an individual or a household and NET calculates Total Assets minus Total Liabilities.

Considering the above indicators, the Chartbook of Economic Inequality in India is represented as follows:

Following observations can be made from the above graph:

From 1993 to 2004, the Gini Coefficient for individual earnings increased by 8% points and from 1994 to 2010, it increased by 3%. After independence, the country saw a fall in overall inequality. Poverty has been declining at least since 1983, however, only measures of absolute poverty have been considered. The Top Income Shares declined from 1940 to 1980 and later increased such that the share of the top 1% doubled. There is evidence that the distribution of wealth did not follow the same pattern as income.

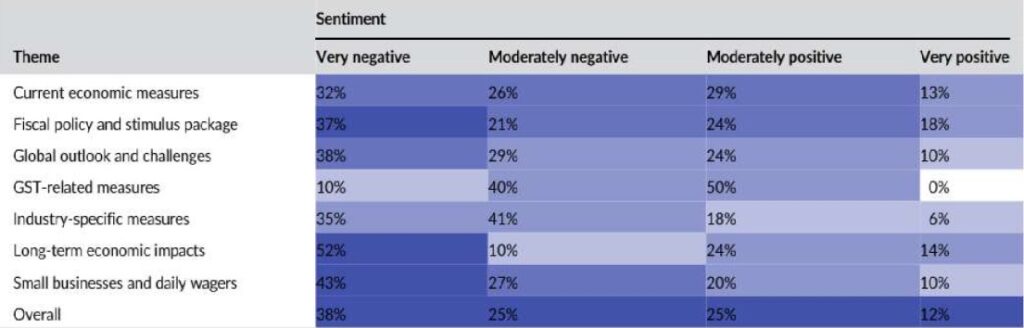

A Sentimental Analysis conducted by Sharma et al., (2020) revealed the various policy measures implemented by the Indian Government to combat the pandemic and overcome economic inequality.

The above sentimental analysis conveyed an overall negative outlook about the global challenges and the industry-specific measures taken by the Government, except the GST (Goods and Services Tax) related measures which seemed to be positive. The prospects of a progressive economy or employment opportunities did not reflect any hope of recovery as the economy had already been slowing down. Hence, it is important to understand the measures taken by the policymakers to tackle this situation.

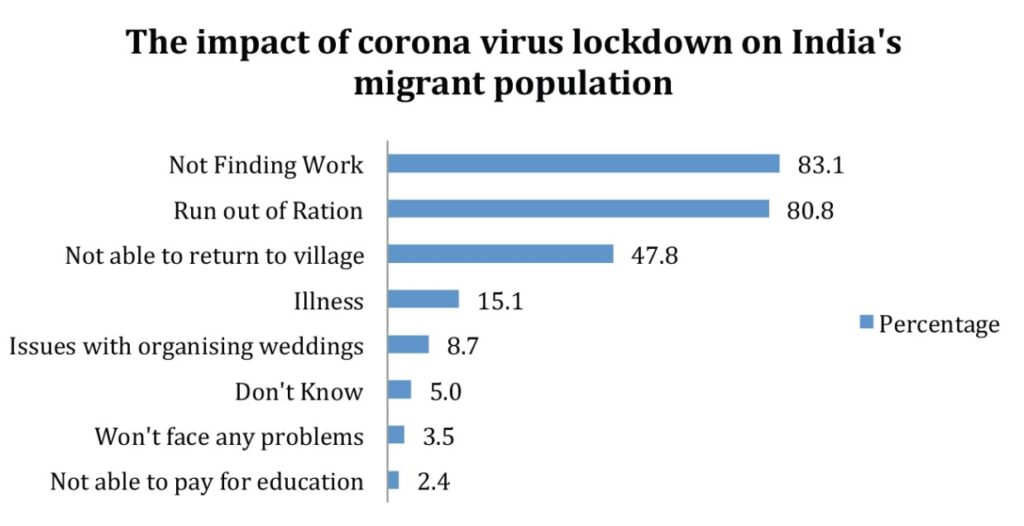

Slowly the economy reopened after the debacle and the government announced several graded relaxation measures after bifurcating the geographical areas into orange, green and red alert zones. The Government declared almost 1% of GDP i.e., $22.6 billion in financial assistance that included: direct cash deposits into personal accounts and food amenities which benefitted millions of families who were below the poverty line and daily wage earners. There were many sectors mainly tourism, hospitality, retail and construction which faced a major setback during the lockdown. Reverse migration from cities to villages took place on a large scale which resulted in a lack of work labour force post lockdown. Providing financial packages to the poor resulted in a huge fiscal burden on the Government. Many experts felt that the Government is lacking in strengthening the public health system. According to a report by Dun and Bradstreet, the three significant channels of impact for Indian businesses are legal linkages, supply chain and macro-economic factors (Press Trust of India, 2021).

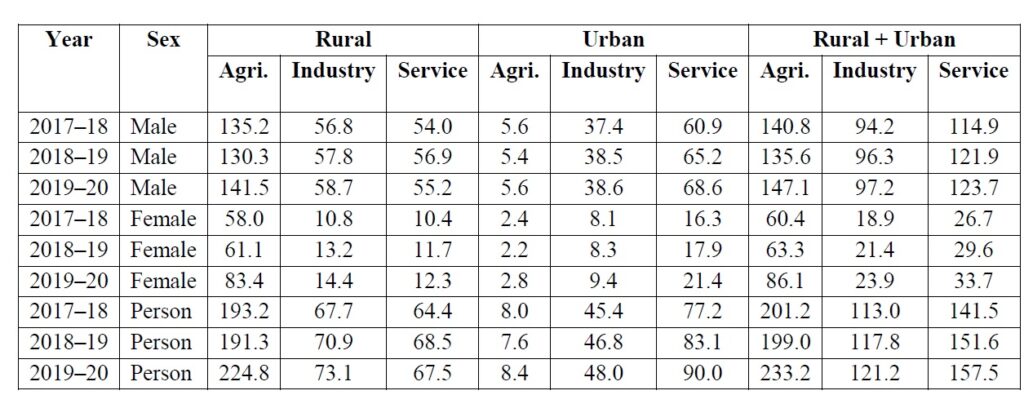

Number of Workers employed in Agriculture, Industry and Services during PLFS years in Millions. (PLFS – Periodic Labour Force Survey)

The total number of jobs in industry and services increased from 2019 to 2020 despite being affected by the pandemic. The job creation in the industry and service sectors during this period could not increase due to the Covid -19 impact. However, the agriculture sector showed a reverse declining trend even during the pandemic due to the increase in horticulture activities (Chand and Singh, 2022)

The International Labour Organisation has described the pandemic as “the worst global crisis since World War II” since 400 million which constitute about 76.2% of the total workforce who worked in the informal economy were pushed deeper into poverty due to the devastating consequences of Covid-19. The migrant workers did not have any intention to return to the industrial towns as they settled in their villages working on farms and this had a long-lasting effect on the economy.

Following the second wave, further lockdown measures were enforced. On January 3rd, 2021, India’s Central Drugs Standard Control Organisation provided emergency use authorisation for the Covishield vaccine and Covaxin as both these vaccinations were manufactured domestically in India. The Government also announced the world’s largest vaccination drive in the following months. From March 2020, RBI (Reserve Bank of India) reduced the Repo and Reverse Repo rates to 4 and 3.35 respectively. Securities and Exchange Board of India relaxed the norms related to debt default. Refinance facilities to MSMEs (Micro, Small and Medium Enterprises) and a Reduction in Liquidity Coverage Ratio were implemented. The moratorium was given to borrowers of personal finance. The limit for FPI (Foreign Portfolio Investment) investment in Corporate Bonds was increased to 15%. Restrictions on non–resident investment in specified securities issued by the Central Government were removed (Reserve Bank of India, 2021).

The above policy measures made India bounce back with the same vigour as one of the strongest nations which successfully combated the pandemic. As India heaved a sigh of relief, fighting against the pandemic, in December 2021, two cases tested positive for a new variant of coronavirus called Omicron. The country had to face new challenges this time as the new variant was highly transmissible and there was an unprecedented surge in the number of cases across the globe. The World Health Organisation approved that Covid – 19 vaccines proved to be very effective in preventing deaths due to Omicron and protecting against other variants like Delta One. India succeeded this time too in fighting against the existent deadly viruses as 72.7% of the population received at least one vaccination dose as of date, 62.2% are fully vaccinated and 1.9% of the population received booster injections (Ritchie, 2022).

Public Health was relatively under control but the Monetary Policy released in October 2021 could not meet the issues that arose due to the geopolitical situation in India regarding economic growth and inflation. Various global issues stormed the fiscal structure of the country like supply chain disruptions, increased fuel prices, tighter labour markets, volatility in financial and commodity markets and Russia – Ukraine developments. However, the GDP rose by 8.9% in 2021 – 22 assuring the chance of revival of the economy.

With bitter lessons learnt from the past, India is well–prepared to combat any such crisis in the future. With a rich cultural heritage and abundant natural resources, be it Ayurveda or Yoga, India leads from the front in medicines and supplies 60% of vaccines to the world. However, certain modifications in the fiscal policies and industry-specific measures would help the country stabilize the economy in the long – run. Goods and Services Tax may be deferred for certain industries like aviation, hospitality and small businesses till they stabilise their earnings. But the biggest lesson learnt from the pandemic is that the Government needs to pay attention to the underprivileged and marginalised section of the population. Finally, a National Health Program for communicable diseases and child health has to be formulated which would revitalise and strengthen the economy.

The real possibility of eliminating the Covid-19 pandemic resulted in ‘PANDEXIT’ which meant the end of the CORONOMIC Crisis. However, such a crisis always helps an economy to rethink the measures undertaken for the development of the human, community and society as a whole. The Country should adopt sustainable developmental models to become a stronger and healthier economy which is self-reliant.

(The author has graduated in Economics & Finance from a university in the United Kingdom. He is an incoming MSc Finance student at Kings College London. He tweets at @AshikMayakonda)

Bibliography:

- Atkinson, A. B., Hasell, J., Morell, S., & Roser, M. (2017). India – The Chartbook of Economic Inequality. The Chartbook of Economic Inequality. https://www.chartbookofeconomicinequality.com/inequality-by-country/India/

- Chand, R., & Singh, J. (2022). Workforce Changes and Employment: Some findings from PLFS Data Series. NITI Aayog Discussion Paper. https://www.niti.gov.in/sites/default/files/2022- 04/Discussion_Paper_on_Workforce_05042022.pdf

- Chaudhary, M., Sodani, P. R., & Das, S. (2020) Effect of COVID-19 on Economy in India: Some Reflections for Policy and Programme. Journal of Health Management, 22(2), 169–180. https://doi.org/10.1177/0972063420935541

- Dev, S. M., & Sengupta, R. (2020). Covid-19: Impact on the Indian Economy. Indira Gandhi Institute of Development Research, Mumbai. http://www.indiaenvironmentportal.org.in/files/file/Covid-19-Impact-on-the-IndianEconomy.pdf

- Deaton, A., & Dreze, J. (2002). Poverty and Inequality in India: A Re-Examination. Economic and Political Weekly. https://rpds.princeton.edu/sites/rpds/files/media/deaton_dreze_poverty_india.pdf

- Dhingra, S., & Ghatak, M. (2021, July 30). How has Covid-19 affected India’s economy? Economics Observatory. https://www.economicsobservatory.com/how-has-covid-19- affected-indias-economy

- TIME TO CARE Wealth Inequality and Unpaid Care Work for Women in India. (2020). OXFAM India. https://www.oxfamindia.org/sites/default/files/2020- 01/India%20supplement.pdf

- Ghosh, A., Nundy, S., & Mallick, T. K. (2020). How India is dealing with the COVID-19 pandemic. Sensors International, 1, 100021. https://doi.org/10.1016/j.sintl.2020.100021

- International Monetary Fund. Communications Department. (2021). Finance and Development, June 2021 (Finance & Development). INTERNATIONAL MONETARY FUND.

- IMF. (2021). World Economic Outlook Database April 2021. https://www.imf.org/en/Publications/WEO/weo-database/2021/april

- Kaushik, S., Kaushik, S., Sharma, Y., Kumar, R., & Yadav, J. P. (2020). The Indian perspective of COVID-19 outbreak. VirusDisease, 31(2), 146–153. https://doi.org/10.1007/s13337-020-00587-x

- Kapur, M. (2020, April 7). Coronavirus lockdown hits India migrant workers’ pay, food supply. Quartz. https://qz.com/india/1833814/coronavirus-lockdown-hits-indiamigrant-workers-pay-food-supply/

- Murshed, S. M. (2022). Consequences of the Covid-19 for Economic Inequality. COVID-19 and International Development, 59–70. https://doi.org/10.1007/978-3-030-82339-9_5

- Reserve Bank of India. (2021). Minutes of the Monetary Policy Committee Meeting, December 6 to 8, 2021 [Under Section 45ZL of the Reserve Bank of India Act, 1934]. Department of Communication. https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR1402MPCCEAB6A72D2544A9 8A02694F772FCC5A4.PDF

- Ritchie, H. (2022, April 29). Coronavirus Pandemic (COVID-19). Our World in Data. https://ourworldindata.org/coronavirus

- Sharma, D. M., & Sharma, D. V. (2020). COVID -19 and Economic Shocks: An Analysis in Indian Context. Mainstream, VOL LVIII No 18 New Delhi. http://www.mainstreamweekly.net/article9321.html

- Sharma, G. D., Talan, G., & Jain, M. (2020). The policy response to the economic challenge from COVID ‐19 in India: A qualitative enquiry. Journal of Public Affairs. https://doi.org/10.1002/pa.2206

- Sharma, G. D., Talan, G., Srivastava, M., Yadav, A., & Chopra, R. (2020). A qualitative enquiry into strategic and operational responses to Covid‐19 challenges in South Asia. Journal of Public Affairs. https://doi.org/10.1002/pa.2195

- The Lancet. (2020). India under COVID-19 lockdown. The Lancet, 395(10233), 1315. https://doi.org/10.1016/s0140-6736(20)30938-7

- Worldometer. (n.d.). India COVID – Coronavirus Statistics – Worldometer. https://www.worldometers.info/coronavirus/country/india/