- Despite high costs and environmental concerns, the Alaska LNG project has regained traction under Trump 2.0, which has prioritized fossil fuel exports to improve trade relations and US economic dominance.

- Japan increased its LNG imports after the Fukushima accident in 2011 because nuclear reactors had to be shut down and its rising reliance on imported LNG made it one of the world’s largest consumers.

- China has been importing more LNG, and in recent years, the United States has emerged as its largest supplier.

- India’s diverse LNG imports from Qatar, the United States, Russia, and Australia place it in a unique position as global energy dynamics alter.

The Role of the Alaska LNG Project and Asia’s Energy Shift

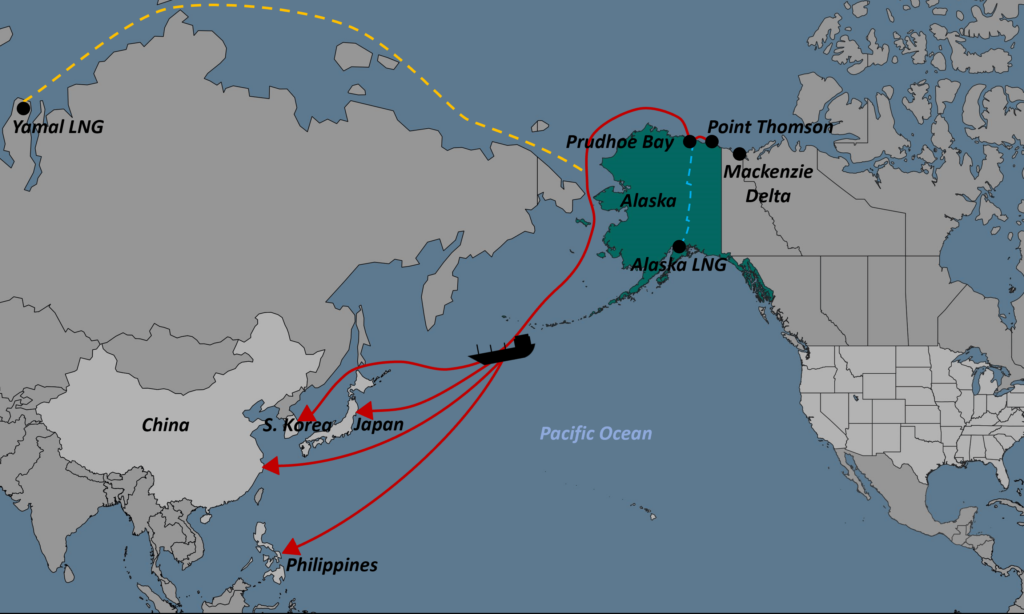

The United States is transforming Asia’s energy environment by increasing natural gas exports, with the Alaska LNG Project playing a critical role. This venture seeks to transport natural gas from Alaska’s North Slope to South Korea and Japan markets. Despite previous delays due to high costs and environmental concerns, the project has regained traction under President Donald Trump’s administration, which prioritizes fossil fuel exports to improve trade relations and US economic dominance.

Alaska LNG Project: Setbacks and Comebacks

The Alaska LNG Project, first proposed over a decade ago, suffered substantial setbacks when major oil corporations like ExxonMobil, BP, and ConocoPhillips withdrew in 2016[1], citing cost concerns. Environmentalists also voiced their dissent about the project’s carbon footprint, prompting legal action and petitions were filed against the Federal Energy Regulatory Commission (FERC) contesting the project’s approval.[2] In 2025, the Alaska Gasline Development Corporation (ADGC) collaborated with Glenfarne Group to relaunch the project, handing over financial control to private investors. President Trump’s new executive order has expedited federal permits and infrastructure support.

U.S. Energy Policy in Asia: Fortifying Partnerships

Increasing U.S. LNG exports is a key component of President Trump’s energy strategy to close trade gaps, generate employment, and strengthen ties, especially with South Korea and Japan. The growing interest in U.S. LNG for energy security is indicated by recent talks with Japanese Prime Minister Shigeru Ishiba and a joint statement from South Korean and Japanese ministers. In line with larger geopolitical goals, the administration’s strategy pushes Asian allies to lessen their dependence on Middle Eastern and Russian gas. During Trump’s first term, his government left the Trans-Pacific Partnership (TPP)[3] to renegotiate trade accords that favoured US energy exports. His present initiatives follow the same pattern, encouraging Asian partners to rely more on US energy.

Japan’s Post-Fukushima Energy Transition

Japan increased its LNG imports after the Fukushima accident in 2011 because nuclear reactors had to be shut down[4]. Japan’s rising reliance on imported LNG made it one of the world’s largest consumers. The imports of LNG have dropped from 88.5 million tons in 2014 to 66.2 million tons in 2023[5] as a result of recent initiatives to revive some nuclear facilities and make investments in renewable energy. Despite this decrease, Japan still considers U.S. LNG to be a dependable and affordable choice; in 2023, imports from the U.S. increased by 33.6%, making it the country’s fourth-largest supplier of LNG. The pledge by Prime Minister Ishiba to boost LNG imports to the United States highlights Japan’s approach to striking a balance between energy diversification and close connections to the United States.

The Impact of Japan as an LNG Hub on ASEAN Energy Dynamics

To improve its energy security and persuade ASEAN nations to move away from Chinese and Russian energy sources, Japan is establishing itself as a major centre for U.S. LNG shipments to Asia. This approach is demonstrated by projects such as Tokyo Gas’s 20% ownership of the FGEN LNG[6] terminal in the Philippines and JERA’s investigation into potential investments in gas-fired power stations in Vietnam. Japan aims to oppose China’s regional influence and help U.S. attempts to increase LNG exports by offering alternative energy options. In addition to fostering U.S. LNG exports, President Donald Trump’s support of the Alaska LNG project improves Japan’s economic relations with its neighbours.

Russia and China: Strengthening Energy Alliances

China and Russia are strengthening their energy cooperation in reaction to the U.S. LNG boom. China has been importing more LNG, and in recent years, the United States has emerged as its largest supplier[7]. However, this energy relationship is now shaky due to trade disputes and tariffs. China receives substantial natural gas supplies from Russia via the Power of Siberia pipeline. The Power of Siberia pipeline is a massive undertaking that spans over 5,111 kilometres (3,175 miles) from Russia’s Siberian gas reserves to China’s eastern regions, including Shanghai.[8]

The Power of Siberia 2 pipeline project intends to use Mongolia to deliver an extra 50 billion cubic meters of natural gas per year from Western Siberia to China. These initiatives are part of Russia’s plan to shift its energy exports to Asia, particularly in light of Western sanctions and a contracting European market. China can lessen its susceptibility to geopolitical concerns by obtaining a steady gas supply from Russia as an alternative to importing LNG from the US and Australia.

India’s Strategic Calculus: Shifting LNG Alliances in Asia

India’s energy landscape is likely to change substantially as global LNG dynamics shift. As Japan increases its imports of US LNG, the action could have a knock-on effect on LNG pricing, thereby influencing the costs for Indian importers. India’s diverse LNG imports from Qatar, the United States, Russia, and Australia place it in a unique position as global energy dynamics alter. The United States is pressing India to increase LNG imports[9] as part of a broader Indo-Pacific policy aimed at strengthening bilateral ties and countering Chinese influence. Japan’s growing acquisition of US LNG creates potential for India to form new energy alliances, such as collaborations on LNG infrastructure and technology exchange. Such partnerships have the potential to strengthen India’s energy security while also contributing to regional stability and progress.

The Road Ahead: Shifting Alliances and Uncertain Outcomes

Japan’s pledge to boost U.S. LNG imports in the near future depends on its viability from an economic standpoint. Although diversifying energy sources is valued in Japan, issues with infrastructure costs and pricing competitiveness may prevent widespread adoption. Tokyo might take a cautious approach, balancing U.S. LNG with current supplies, if costs stay high.

Changes to LNG supply chains may have serious repercussions for India. India might have to deal with higher pricing or less supply if Japan takes a bigger chunk of American exports. This might encourage India to strengthen its relations with Russia and Qatar or to make more significant investments in indigenous energy sources like domestic gas exploration and renewables.

The U.S.-Japan LNG alliance has the potential to change Asia’s energy geopolitics in the long run. If effective, it might lessen the power of China and Russia in the local energy markets. But if Trump’s initiatives don’t last throughout his term, things might slow down, giving Russia and China a chance to recover sway.

References:

- [1] https://www.thechemicalengineer.com/News/exxonmobil-and-partners-quit-lng-project/

- [2] https://www.offshore-energy.biz/authorization-of-alaska-lng-is-lawful-and-reasonable-u-s-appeals-court-says/

- [3] https://www.nytimes.com/2017/01/23/us/politics/tpp-trump-trade-nafta.html

- [4] https://www.csis.org/analysis/how-japan-thinks-about-energy-security

- [5]https://www.eia.gov/todayinenergy/detail.php?id=61683

- [6] https://www.reuters.com/business/energy/tokyo-gas-enters-philippine-lng-market-with-terminal-stake-2025-02-19/

- [7] https://rbac.com/chinas-lng-surge-surpasses-japan-as-top-lng-importer/

- [8] https://www.reuters.com/business/energy/china-completes-full-pipeline-power-of-siberia-gas-2024-12-02/

- [9] https://www.ft.com/content/e029e3aa-120f-49d6-951f-ad51e7a1a533

Pranav S is a Project Assistant at the Energy Department, Government of Karnataka with an MA in Public Policy. Views expressed are the author’s own.