- Multiple studies indicate that India’s oil needs will be more than any other country by 2040

- Domestic prices of petrol and diesel in India are linked to global fluctuations. 60% of India’s crude oil requirement is fulfilled by Iraq, Iran and Saudi Arabia

- Aggressive purchase of foreign currency for importing oil leads to devaluation of rupee and ultimately affecting India’s purchasing power

- It will have a cascading effect like depreciation of rupee and will see a big rise in commodity prices leading to inflation.

- This is where the importance of domestic production, strengthening of indigenous industries and import substitution comes into picture.

- Alternative energy sources like natural gas and solar power is one way to reduce dependence on imported crude oil.

Recently, the US President Joe Biden while speaking about a country being dependent on supply chain said, “For want of a nail, the shoe was lost. For want of a shoe, the horse was lost. This goes on and on until the kingdom is lost, all for the want of a nail. Even small failures at one point in the supply chain can cause unimaginable impact further up the chain.” India the second most populous nation and the 7th largest country by area in the world has to import 82% of its petroleum to meet its requirements, making it the 3rd largest importer of crude oil after China and USA.

Multiple studies indicate that India’s oil needs will be more than any other country by 2040, citing the speed at which the country’s energy needs are growing. If a nail can result in the loss of a kingdom, the oil import variations can change governments in India. The whole supply chain glut is dependent on peace and stability in the Middle-East. So any volatility in the Middle East or OPEC countries is keenly watched and analyzed in India.

Indian Petroleum Minister Dharmendra Pradhan had in 2015 called oil purchases a “weapon” for the country. India had imported 270 Million Metric Ton of crude oil valuing $120 billion in 2019-20. Three decades ago during the Gulf War of 1991, India ran out of foreign exchange needed to import petroleum products and had to mortgage gold to overcome the crisis. This step had further ramifications like the devaluation of rupee, which made imports costlier.

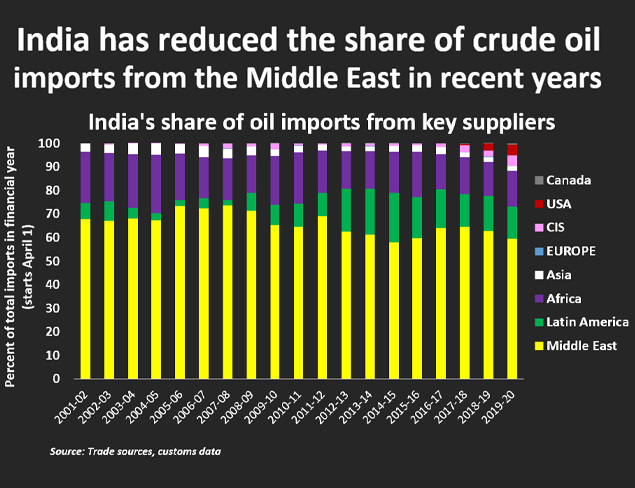

Domestic prices of petrol and diesel in India are linked to global fluctuations. 60% of India’s crude oil requirement is fulfilled by Iraq, Iran and Saudi Arabia, who are presently facing various crises ranging from civil war to political instability, affecting their output of mineral oil extraction. These countries also have considerable say in the Organization of Petroleum Exporting Countries (OPEC), a cartel that controls the global crude oil market and influences the foreign exchange reserves of oil importing nations like India. Since oil is procured by making large payments in dollars, the PM Narendra Modi’s government and RBI have to ensure sufficient availability of foreign currency by selling local currency in the international foreign exchange market.

Aggressive purchase of foreign currency leads to devaluation of rupee and ultimately affecting the purchasing power of Indian residents. This will have a cascading effect like depreciation of rupee and will see a big rise in commodity prices leading to inflation. This is where the importance of domestic production, strengthening of indigenous industries and import substitution comes into picture. If a nation is largely self-sufficient, its foreign exchange reserves would steadily grow as imports would be limited, leading to decrease in price of goods and services required by the populace, thereby enabling easy procurement and contributing to a better way of living.

Can there not be an alternative for India so that it is not dependent wholly on the Middle East for oil? Can ‘Atmanirbhar Bharat’ initiative play a role in attaining self-sufficiency in oil? Can Indian economy escape from the clutches of the Middle East under the Saudi leadership and OPEC+? Can India make alternative arrangements?

Firstly, according to the US Energy Information Administration, India has the 2nd largest proven oil reserves in Asia-Pacific region. So far the production is done only at 5 locations namely Barmer district of Rajasthan, Gulf of Khambhat (Gujarat), Mumbai High Sea, Godavari-Krishna Basin and in Assam. The data available from Energy Statistics 2019 report of Ministry of Statistics & Programme Implementation mentions that Kutch district of Gujarat, Cauvery basin (Tamil Nadu), Mahanadi basin (Odisha), Hugli basin (West Bengal), and offshore location in Bay of Bengal, on eastern Continental Shelf have known occurrences of oil and gas but commercial production is yet to be established. Also the total geographical area of resource-rich Indian sedimentary basins on western and eastern coasts, turns out to be far greater than that of Persian Gulf, which is a global oil and gas hub.

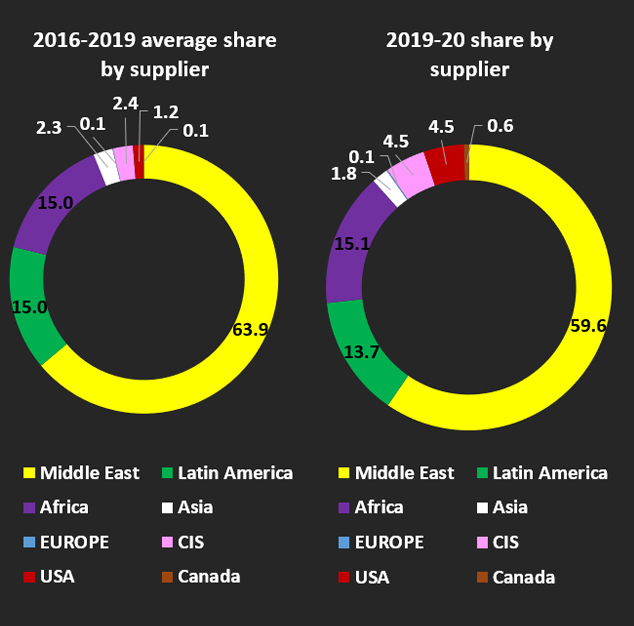

Secondly, in order to prevent any future crude shock, India has successfully developed 3 Strategic Petroleum Reserves at Visakhapatnam (Andhra Pradesh), Mangalore and Padur [Karnataka] while a 4th one at Chandikhol (Odisha) is under construction, providing a total fuel storage capacity of 5.33 Million Metric Ton or enough to suffice 10 days of consumption. In 2019/20 Indian refiners took in a record proportion of alternate crudes, including from the United States, Latin America and the Mediterranean as a narrowing in price spreads between marker grades such as Brent and U.S. light crude helped offset shipping costs to India. Middle East oil tends to yield more diesel, while crude from the North Sea, West Africa and U.S. shale fields usually produce more LPG and gasoline. Crude imports from Nigeria, U.S. surged almost according to government data.

Now India asked refiners to speed up diversification and reduce dependence on the Middle East days after OPEC+ said it would maintain production cuts. Indian refiners plan to cut imports from the Kingdom by about a quarter in May, dropping them to 10.8 million barrels from monthly average of 14.7-14.8 million barrels. OPEC+ cuts have created uncertainty and made it difficult for refiners to plan for procurement and price risk. It also creates opportunities for companies in the Americas, Africa, Russia and elsewhere to fill the gap.

Thirdly, as Prime Minister Narendra Modi said India’s middle class would not have been burdened by oil prices if previous governments had focussed on reducing India’s energy import dependence. “Can we be so import-dependent? I don’t want to criticise anyone but I want to say (that) had we focussed on this subject earlier, our middle-class would not have been burdened.” The central government under PM Modi’s leadership had earlier set a target to reduce the country’s crude oil import dependence by 10 per cent by 2022.

Fourthly, using alternative energy sources like natural gas and solar power is one way to reduce dependence on imported crude oil. It will not only help the government save billions on imported fuel but prevent the country from energy price shocks at the global level. Some experts have earlier highlighted that the higher use of natural gas may be the only way out for India as far as reducing oil import dependence is concerned. And while India’s natural gas consumption is rising, the country imports more than half of its requirements.

Fifthly, India should really focus on going electric as it will help reduce the dependence on fuel to a massive extent. Government officials had earlier claimed that 30 percent of the cars sold in India by 2030 will be EVs. A 2019 report of the Council on Energy, Environment and Water (CEEW) suggests that India could have saved over 50 million barrels of crude oil if 30 percent of the cars sold that year would have been electric.

Sixthly, India is already trying to cut its dependence on Middle Eastern crude, with US oil rising from 0.5% of total purchases to 6% over the past five years. African nations could play a central role in India’s oil diversification. The country is looking at signing a long-term oil supply deal with Guyana and exploring options to raise imports from Russia. India expects Iranian sanctions to ease in three to four months, potentially offering India a cheaper alternative to Saudi oil. Venezuela, Kuwait and the US are other options where India can diversify its imports.

At last one can say that under the present administration India imports oil from all over the world. Its dependence on the Middle East for oil has greatly reduced. PM Modi had said that diversifying energy sources has become the Mantra for his government. Work has started in India to ensure that 40 per cent of all energy generated is renewable by 2030. The PM added that the government is working towards raising the share of natural gas in the energy basket to 15 per cent from 6.3 per cent. He also said that the government is committed to bring natural gas under GST to eliminate cascading taxes, a major hurdle at the moment.

(The views expressed are author’s own and need not necessarily reflect the views of SamvadaWorld)

M.AM.PhiL/(PhD SNU South Korea)