- Unlike paper currencies, cryptocurrencies are decentralized i.e there is no central authority that issues, controls or overlooks them.

- “Block chain” is the underlying technology and the security of cryptocurrencies are backed by computer encryption algorithms like hashing and cryptography giving them the adjective “crypto”-currency.

- Start-ups are keen on utilizing this as an investing tool which will provide them independence over Venture Capitals with the usual method of investments.

- Due to the anonymity of the transacting parties, it exposes many loopholes to players for criminal activities like illegal weapon and drug dealing, terrorist activities, tax evasions etc.

Cryptocurrency, in particular Bitcoin is one among the buzzwords that is going around in India and internationally too. In this article let us try to understand in simple words the technicality of the underlying technology of cryptocurrency, the pros and cons, and how it can affect the economy of a country and the world.

We all know how the printed notes/coins work. Also called fiat money, it is issued by a government, controlled by central authorities like the Reserve Bank of India. They have control over the number of notes printed and their value/trust. With the advent of smartphones and digital technologies, now we are able to transact money digitally over mobile apps like PhonePe, Google Pay etc. which are intangible. Note that every transaction is captured by banks and they have a centralized database to track them.

How do they work?

Cryptocurrency is a form of digital asset. The difference is that unlike typical currencies, cryptocurrencies are decentralized i.e there is no central authority that issues, controls or overlooks them.The first ever known and the most famous crypto is the “Bitcoin” started in the year 2009. “Block chain” is the underlying technology upon which cryptocurrencies thrive. The security of cryptocurrencies are backed by computer encryption algorithms like hashing and cryptography giving them the adjective “crypto”-currency.

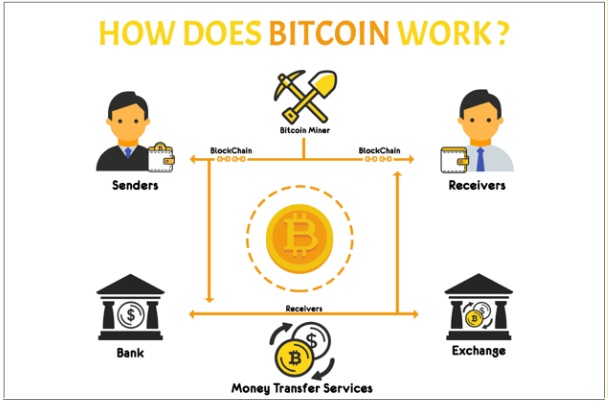

Let us understand a simple bitcoin transaction. Say, I want to send you a bitcoin (BTC). This transaction can happen over a block-chain network with participants called “nodes” (think of it as a simple PC for convenience). You and I need to have a unique address called a wallet ID. This makes both parties anonymous. Every transaction that has occurred on the network is stored as a block (ledger of transaction) with every participating node having the copy of it, making this open and distributed. “Miners” who are also nodes on the network will confirm our transaction as valid, meaning, there is no double spend of transfer once a transaction is initiated between two parties. Once this is verified, the BTC transfer is complete (-1 in my account and +1 to you). This transaction will be permanently written (on a block and added to the chain) in the network. The latest ledger is shared to all nodes in the network.

Advantages

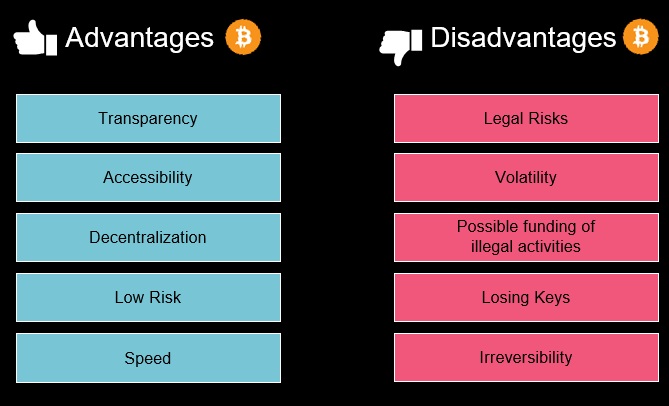

Crypto market has provided many benefits for its holders and traders.The total market capitalization of the entire crypto is ~1.5T USD with bitcoin leading it around 587B USD. The US electric car company Tesla had also allowed BTC as a legal tender until recently stating the environmental concerns with BTC mining power consumption as the reason. Cryptos allow easy transfer of coins directly between parties across borders without any intermediary required. There are almost no/minimal transfer fees.

Start-ups are also keen on utilizing this as an investing tool which will provide them independence over Venture Capitals with the usual method of investments. Crypto investors also believe that it is a very good asset to overcome inflation.

Potential threats and risks

Due to the anonymity of the transacting parties, it exposes many loopholes to players for criminal activities like illegal weapon and drug dealing, terrorist activities, tax evasions etc. Moreover there are no regulatory boards in case of any fraud that may possibly occur. This poses a challenge for governments to overlook these issues.

The 24/7 open market and high volatility creates a threat for coin holders to lose their value in quick time. Since the market is not dependent on any factors like in stock markets. It runs merely by speculations and trust of the issuing group. There are also chances of discontinuation of coins. In such cases one might lose out hard earned money. Ways to overcome these problems are to be aware of the crypto market and always keep updated about the coins one is holding. Financial common sense also can help someone utilize the opportunity without harming their economics.

Not to forget that the underlying computing technology is always prone to attacks. Though backed by encryption algorithms it is open to 51% attacks. Miners are the people who validate transactions across the network. There may arise a point when such a mining group can control 51% of the network which can lead to fraudulent transactions being passed and hampering the truthfulness of the network. But this is not as easy as we think because the cost of computational power to control 51% of the network would surpass the advantage of acquiring access to 51% network traffic.

Any news and China can’t be away from it. The “miners” are awarded with coins as an incentive. Recent surveys show that about 65.3% of mining traffic is from China. This means that the Chinese are accumulating cryptos and it should not be a surprise if they start controlling the domain sooner or later.