India’s Economic Opportunity: By addressing supply chain vulnerabilities and leveraging its youthful demographic, India can position itself as a global manufacturing and investment hub amidst China’s economic stagnation.

Strategic Lessons from China: India can avoid pitfalls like debt dependency and over-reliance on specific sectors by fostering transparency, innovation, and sustainable infrastructure development.

Collaboration over Competition: While competing economically, India and China can collaboratively enhance BRICS, promoting multipolarity, resilience, and shared global economic goals.

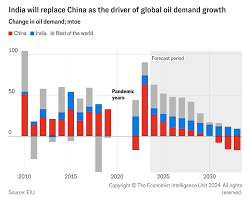

As China experiences a period of economic stagnation marked by structural challenges, India stands at a pivotal moment to capitalize on the lessons this slowdown offers. The hurdles China faces—from demographic shifts to supply chain vulnerabilities—present India with unique opportunities to enhance its own economic prospects and position itself as a competitive alternative in the global market. By learning from China’s economic challenges, India can strategically prepare for sustainable growth and resilience in an evolving world economy.

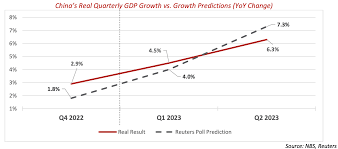

The International Monetary Fund (IMF) projected India’s GDP growth at 6.1% for 2023, with expectations to maintain around 6-7% through 2024. China’s growth rate has slowed down to around 3-4%, compared to its double-digit growth of previous decades in the same time period. As per UNESCAP’s 2023 report on FDI trends in Asia Pacific, India attracted around $70 billion in FDI in 2022, marking it as a preferred destination, particularly in the manufacturing and digital sectors. Key investors include the U.S., Japan, and Singapore. FDI inflows to China were approximately $180 billion in 2022, but investment growth has stagnated due to economic challenges and geopolitical tensions.

World Bank Data suggests that India’s median age is 28.4 years, with nearly two-thirds of its population under 35, which provides a significant workforce advantage. China’s median age is 38.4 years, and it is experiencing a demographic shift with a declining birth rate and an ageing population, increasing social and healthcare costs.

In one of the largest international trade pacts, as of 2023, China has loaned over $900 billion through BRI projects, and many recipient nations like Sri Lanka and Pakistan face debt distress, with some paying over 10% of their annual GDP toward debt to China.

As per the Financial Times report, China’s debt-to-GDP ratio exceeded 280% by 2023, largely due to heavy borrowing in the real estate and infrastructure sectors. Concerns over real estate defaults (e.g., Evergrande) have further stressed the economy. India’s debt-to-GDP ratio is approximately 85%, far lower than China’s, with manageable public debt levels and a focus on fiscal consolidation. India’s merchandise exports reached around $450 billion in 2023, showing diversification into electronics, pharmaceuticals, and textiles. While China remains the largest exporter globally, its exports to the U.S. have declined by about 15% over the past year due to trade tensions and diversification of supply chains by Western companies.

These patterns serve as a wealth of lessons for India as it seeks to secure a stable and sustainable growth pathway.

Key Lessons and Strategies for India

Diversification of Supply Chains

China’s economic downturn has led many countries to reconsider the risks of over-reliance on a single nation for their supply chains. India, with its vast workforce and growing industrial base, is well-positioned to attract industries such as electronics, pharmaceuticals, textiles, and automobiles. To capitalize on this opportunity, India should prioritize:

- Enhanced Infrastructure: Improving logistics, ports, and transportation networks to facilitate the smooth movement of goods.

- Regulatory Ease: Streamlining processes, reducing bureaucratic delays, and offering competitive incentives to make India an attractive manufacturing hub.

By positioning itself as a viable alternative, India can become a preferred destination for companies seeking to diversify away from China.

Attracting Foreign Direct Investment (FDI)

As China’s appeal as an investment hub wanes, India has the chance to draw in foreign capital by fostering a stable, business-friendly environment. Some strategies include:

- Tax Incentives and Simplified Processes: Offering competitive tax benefits and easing land acquisition laws can attract global corporations seeking alternatives.

- Investment in Skill Development and Labor Reforms: Ensuring a skilled workforce and modernizing labour laws to suit global corporate requirements will be essential.

Recent shifts in global sourcing patterns, such as Walmart’s increased procurement from India, indicate a growing interest in India as a manufacturing and investment destination.

Boosting Innovation and R&D

China’s economic slowdown has revealed gaps in its innovation ecosystem. India can seize this moment to emerge as a leader in innovation by investing in:

- Research and Development: Focusing on high-tech sectors such as semiconductors, biotechnology, artificial intelligence, and renewable energy.

- Academia-Industry Collaboration: Encouraging partnerships between educational institutions and industry players to accelerate technological advancements.

India’s strides in innovation will be instrumental in creating a self-reliant economy capable of competing on a global scale, while also reducing dependency on imported technology.

Recognizing the Risks of Debt-Trap Diplomacy

One of the challenges faced by China is the global backlash against its “debt-trap diplomacy,” where developing nations have become overly reliant on Chinese loans for infrastructure projects, ultimately compromising their economic sovereignty. This approach has highlighted a pattern of exploitation that undermines trust.

Notable examples include:

- Sri Lanka: Unable to repay debt from Chinese infrastructure projects, Sri Lanka was forced to lease its Hambantota Port to China for 99 years, sparking concerns about sovereignty and strategic asset loss.

- Pakistan: Through the China-Pakistan Economic Corridor (CPEC), Pakistan has accumulated significant debt, straining its finances and leaving crucial infrastructure under China’s control.

- Zambia and Djibouti: Heavily indebted to China for infrastructure investments, both nations face potential strategic asset control by China, raising sovereignty and geopolitical concerns.

India can learn from these examples by promoting partnerships based on transparency and local empowerment. Initiatives like the Indian Technical and Economic Cooperation Programme (ITEC) and South-South Cooperation have historically focused on mutual benefit, skills development, and technical support, contrasting China’s debt-based model. India’s approach fosters trust and avoids the pitfalls of dependency, positioning it as a reliable partner.

Harnessing the Demographic Dividend

India’s youthful population stands in stark contrast to China’s ageing workforce, providing a significant advantage for long-term growth. To fully leverage this demographic dividend:

- Education and Skill Training: Investment in quality education and targeted skill development programs to prepare youth for new-age, high-growth sectors.

- Women’s Workforce Participation: By enabling greater workforce participation among women, India can unlock an enormous economic potential that remains largely untapped.

This demographic advantage can provide a steady supply of skilled labour and contribute significantly to India’s economic growth.

Strengthening Infrastructure

India’s ambition to become a global manufacturing powerhouse depends on robust infrastructure, both physical and digital. Priorities should include:

- Investment in Transportation and Logistics: Expanding and modernizing road, rail, and port infrastructure to facilitate efficient movement of goods.

- Digital Infrastructure: Enhancing broadband access, data centres, and IT infrastructure to support India’s growing digital economy.

With the government’s continued commitment to infrastructure development, India can attract investments, improve productivity, and accelerate growth.

Strategic Economic Alliances

In an era of shifting global alliances, India’s strategic partnerships within the Indo-Pacific region and beyond are crucial. By deepening ties in multilateral forums such as BRICS and the Quad, India can:

- Promote Regional Stability and Cooperation: Strengthen its geopolitical influence and counterbalance China’s dominance in the region.

- Enhance Trade Networks: Secure trade and investment opportunities that support India’s economic growth and resilience.

Engaging in these alliances allows India to position itself as a responsible regional leader while fostering long-term economic stability.

The Way Forward for India’s Economic Ascent

China’s economic downturn serves as a timely reminder for India to adopt a proactive and diversified approach to growth. By embracing lessons from China’s challenges—such as over-reliance on a single industry, managing demographic shifts, and fostering a culture of innovation—India has a clear pathway to sustainable development. Through supply chain diversification, increased FDI, robust R&D investment, leveraging its demographic strengths, strengthening infrastructure, and building strategic alliances, India can emerge as a formidable player in the global economy.

However, while India and China may find themselves in economic competition, the broader perspective points to a unique opportunity for collaboration. With BRICS nations challenging the G7 dominance, both India and China play pivotal roles in rebalancing global trade and promoting a multipolar world order. A cooperative approach between the two Asian giants could be instrumental in strengthening the BRICS bloc, enhancing economic resilience among non-Western nations, and providing a viable alternative to Western economic models.

This collaboration would not only boost trade and investment but also serve as a foundation for shared technological advancements, infrastructure initiatives, and sustainable development goals within BRICS. By navigating their economic paths strategically, India and China can leverage both their competitive edges and collaborative potential to contribute to a balanced, inclusive, and resilient global economy.