- The project was overpromised and underdelivered as a result of the poorly negotiated agreements, which overwhelmingly favoured China.

- These conditions have led to China being the neo-colonial authority trapping Pakistan into a debt trap in return for its rich adobe of natural wealth.

- The current Chinese investment stands at over $62 billion and is aiming for a structural increase in energy consumption with a lateral spread through its voracious habits.

- The exploitation and extraction of natural resource endowments for its benefit has trapped Pakistan into a spiral circle of non-concessionary loans with conditionalities, which legalised with inter-governmental or private company policies.

Introduction

China’s “Going Out” or “Going Global” strategy is a government-led initiative promoting Chinese businesses’ foreign investment. Former President Jiang Zemin implemented the policy in 2000, and its objectives include: Reaching national security and economic targets, encouraging cultural products and services abroad. In the 21st century, with the resurgence of China as either a status quo or a revisionist power, it is fundamental to analyse that Premier Xi Jinping in the attempt to become a global hegemon, has carefully crafted a framework of Going out policy which promotes a passive strategy to encourage its enterprises to invest overseas.

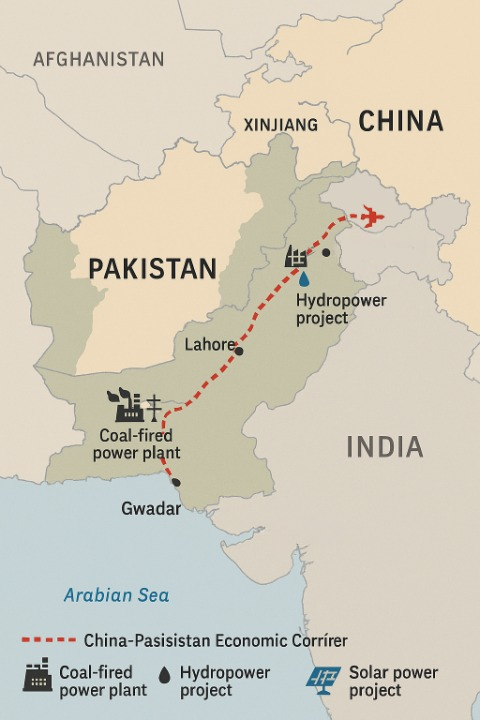

China and Pakistan are closely related in the energy sector, with China funding Pakistan’s energy infrastructure and assisting Pakistan in the growth of its non-renewable and renewable energy. CPEC, the China-Pakistan Economic Corridor, which was introduced in 2015, intends to improve cooperation between China and Pakistan by making investments in industrial development, energy, transportation, and communications. Coal, hydropower, nuclear, solar, and wind farm projects were among the approximately $34 billion invested in Pakistan’s energy sector during the first phase of the China-Pakistan Economic Corridor (CPEC). In recent years, the energy sector has received substantial investments, with a focus on addressing Pakistan’s chronic power shortages. The often debated liberalization with regulation and control over resources, achieving attractive risk-return profiles while ensuring access and affordability of services, balancing the push for private-sector investment with effective public investments, and balancing local and national needs with the global sustainable development agenda is seen in the relations of Pakistan-China.

Building a shipping link for Chinese goods from Gwadar port on the Arabian Sea across the mountain border into China’s Xinjiang region is the main objective of the $65 billion CPEC projects. The largest amount of Chinese debt in the world, $26.6 billion (€24.6 billion), is owed by Pakistan, according to data from 2022. According to analysts, the CPEC loans were first positioned as the most affordable choice for foreign loans, but it soon became apparent that they would be significantly more costly to repay than anticipated. The project was overpromised and underdelivered as a result of the poorly negotiated agreements, which overwhelmingly favoured China. The media and public were misinformed to suggest that CPEC would significantly alter the economic landscape for Pakistan and the region. These conditions have led to China being the neo-colonial authority trapping Pakistan into a debt trap in return for its rich adobe of natural wealth.

The CPEC Energy Projects in Pakistan

China’s non-renewable energy projects in Pakistan primarily focus on coal-fired power plants and liquefied natural gas (LNG) terminals. The current peak summer demand for energy stands at 25,000 MW in response to the currency capacity of Energy supply, which stands at 22,000 MW. These projects aim to address Pakistan’s energy shortages and support economic growth. The China-Pakistan Economic Corridor (CPEC) agreements and articles are based on mutual benefit, cooperation, and long-term strategic partnership between China and Pakistan.

The Key Agreements include: 1. CPEC Framework Agreement (2015): Outlines the scope, objectives, and implementation framework for CPEC. 2. Long-Term Plan (2017-2030): Details CPEC’s vision, goals, and priority areas for cooperation. 3. Energy Cooperation Agreement: Focuses on energy sector collaboration, including power generation and transmission. 4. Transportation Infrastructure Agreement: This covers road, rail, and port infrastructure development. 5. Industrial Cooperation Agreement: Promotes joint ventures, industrial parks, and special economic zones (SEZs).

Energy Security Paradigm of Pakistan

China must secure its energy supply from Pakistan at the best price, making it energy efficient. But it is often faced by the dominant challenge of the ‘Polluter Pays’ principle. It is here wherein China leaves a heavy carbon footprint due to its increased consumption of renewable energy sources. Renewable energy sources, such as wind, solar, water, biomass, geothermal, and ocean energy, are given priority under China’s Renewable Energy Law. A framework for increasing the share of non-fossil energy consumption is also established by the law. Recently, Energy conservation and development are given top priority under China’s Energy Conservation Law, and each province has a target for reducing its energy intensity. China intends to fulfil their financing commitments to support developing nations in achieving SDGs through a collective fund of Climate Justice of USD 100 billion. Further, by 2050, China aims to reduce the share of fossil fuels to less than 50% and by 2060, it wants to achieve carbon neutrality. Thus, one can say that reducing the vulnerability of Chinese oil and gas supplies has been secured as one of China’s top geopolitical priorities.

Pakistan PM Muhammed Shebaz Sharif expressed his commitment to strengthening Pakistan’s relationship with China, particularly regarding the CPEC during his visit to China in June 2024. He emphasized that Pakistan’s “all-weather relationship” with China was “unshakable” and looked forward to launching the second phase of CPEC. He also highlighted the importance of CPEC in promoting economic cooperation and has assured that his government is committed to completing all its projects and resolving issues faced by Chinese companies working in Special Economic Zones.

Matrix of Energy Resources: Financing Policy

The 1st phase of CPEC (2015-20) focuses on energy and infrastructure projects, whereas the 2nd phase of CPEC (2020-30) emphasizes industrial development. The current Chinese investment stands at over $62 billion and is aiming for a structural increase in energy consumption with a lateral spread through its voracious habits. In recent years, Chinese efforts for installation of hydropower, wind water pumping, solar stoves, small wind turbines, geothermal utilization and tidal power stations have been used as a catalyst for open rights to push Pakistan’s economy for the access of commercialization of renewable energy. This creates Chinese Ownership entities and allows them to participate in the market as a legitimate principal consumer. The key players include China Machinery Engineering Corporation (CMEC), China Power International Holding Limited (CPIH), China Three Gorges Corporation (CTG), Huaneng Group and Shanghai Electric. Let us understand the policies that have rendered Chinese efforts to be legalized, justified and standardized to openly exploit the resources much for their self-vested motives.

- Coal

Although there are several renewable energy projects, the majority of the new energy generation capacity within CPEC will stem from coal-based plants. As part of CPEC’s “Early Harvest” projects, $5.8 billion worth of coal power projects are anticipated to be finished by early 2019.

A $970 million coal power plant with a 660 MW capacity is being constructed in the Balochistan province at Hub, close to Karachi, by an alliance consortium of the Pakistani corporation Hub Power Company and China’s China Power Investment Corporation. The project, which is worth $2 billion, aims to generate 1,320 MW using coal.

Another project in Gwadar is the construction of a 300 MW coal power plant, which is being funded by a loan with no interest. Along with a 132 kV (AIS) Grid Station and related D/C Transmission line at Downtown Gwadar, the Gwadar development also includes additional 132 kV Sub Stations at Deep Sea Port Gwadar.

With a capacity of 1,320 MW, the $1.8 billion Sahiwal Coal Power Project is situated in central Punjab and has been operating continuously since 3 July 2017. The plant is jointly owned and operated by Huaneng Shandong and Shandong Ruyi, two Chinese companies that formed a joint venture to build it. The consortium will charge Pakistan 8.36 US cents per kWh for electricity purchases. In the Sindh province’s Thar coalfield, the Chinese company Shanghai Electric will build two 660 MW power plants as part of the “Thar-I” project. China Machinery Engineering Corporation as well as Pakistan’s Engro Corporation, will form a separate consortium to develop the “Thar-II” project, which will involve the construction of two 330 MW power plants. To purchase electricity from Thar-I and Thar-II, Pakistan’s National Electric Power Regulatory Authority (NEPRA) is willing to pay 8.50 US cents per kWh for the first 330 MW, 8.33 US cents per kWh for the next 660 MW, and 7.99 US cents per kWh for the next 1,099 MW as additional phases are developed.

- Liquified natural gas

Projects using liquefied natural gas (LNG) are also seen as essential to CPEC. As part of CPEC, the Chinese government has declared its plan to construct a 711-kilometer, $2.5 billion gas pipeline from Gwadar to Nawabshah in the province. Once sanctions against Tehran are lifted, the 80-kilometer section between Gwadar and the Iranian border will be connected to the 2,775-kilometer Iran-Pakistan gas pipeline. On its side of the border, Iran has already finished 900 kilometers of the pipeline.

China Petroleum Pipeline Bureau, a state-owned company, will build the pipeline’s Pakistani section. China will be able to secure a route for its imports, in addition to giving gas exporters access to the Pakistani market. China’s Harbin Electric Company is constructing the 1,223 MW Balloki Power Plant close to Kasur with funding from China’s EXIM Bank. The 1,180 MW Bhikhi Power Plant near Sheikhupura was also inaugurated by Prime Minister Nawaz Sharif in October 2015. The United States’ General Electric and China’s Harbin Electric Company are working together to build this plant. An estimated 6 million households will have enough electricity from what is predicted to be Pakistan’s most efficient power plant since May 2018.

- Renewable Energy

Instead of being built by the Chinese or Pakistani governments, the energy projects under CPEC will be built by private Independent Power Producers. The Pakistani government will have a contractual obligation to buy electricity from these companies at pre-negotiated rates, and the Chinese Exim Bank will finance these private investments at interest rates ranging from 5 to 6%.

Pakistan declared in March 2018 that after the completion of power plants currently under construction, hydropower projects would be given priority. By 2030, Pakistan wants to generate a quarter of its electricity from renewable projects. As of December 2016, the 6,500-acre Quaid-e-Azam Solar Park near Bahawalpur, which has an estimated capacity of 1,000 MW, is the largest solar power plant in the world, built by China’s Zonergy company. Xinjiang SunOasis finished the project’s first phase, which has a 100 MW generating capacity. Zonergy will install the remaining 900 MW of capacity as part of the CPEC.

The Turkish enterprise Zorlu Enerji constructed the Jhimpir Wind Power Plant, which has already started selling 56.4 MW of electricity to the Pakistani government. At $659 million, the Chinese-Pakistan consortium United Energy Pakistan and others are expected to generate an additional 250 MW of electricity under the CPEC. The Dawood Wind Power Project, another wind farm built by HydroChina for $115 million, is scheduled to produce 50 MW of electricity in August 2016.

With funding from China’s EXIM Bank, the SK Hydro Consortium is building the $1.8 billion Suki Kinari Hydropower Project in the Khyber Pakhtunkhwa province of Pakistan’s Kaghan Valley. The Gezhouba Group is paying for the $1.5 billion Azad Pattan Hydropower Project, which is being built on the Jhelum River. Of the five projects that have been proposed on the River Jhelum Cascade, this one will have the minimum generation tariff due to its 700.7 MW of generation capacity. Further, the Chinese Silk Road Fund provided funding for the Karot Hydropower Project. It was the fund’s inaugural project and a component of its intention to support clean energy in Pakistan, which is one of the corridor’s top priorities.

Although it was announced before CPEC, China’s Three Gorges Corporation was already working on the $2.4 billion, 1,100 MW Kohala Hydropower Project. However, CPEC funds will now be used to finance the project. In 2020, the Three Gorges Corporation, the Chinese government, and the government of Pakistan-administered Kashmir approved the project, despite protests from India, which claims Kashmir as its territory. One of the renewable energy projects is a 640 MW Mahl hydropower project.

Thus, the quest for China being a global hegemon has convened itself as an economic player with the energy sector being a dominant form of engagement in the name of modernization. The exploitation and extraction of natural resource endowments for its benefit has trapped Pakistan into a spiral circle of non-concessionary loans with conditionalities, which legalised with inter-governmental or private company policies.

References:

- Shayan Rauf, “China-Pakistan Economic Corridor (CPEC)”, Encyclopædia Britannica.

- Muhammad Zamir Assadi, “CPEC unfolding opportunities for Pakistan”, Pakistan Observer, 1 February 2023

- Kiani, Khaleeq, “With a new Chinese loan, CPEC is now worth $54bn”, Dawn, 30 September 2016

- Shabaz Rana, “Only 3 CPEC projects in Gwadar completed”, The Express Tribune, 8 May 2022

- Garlick, Jeremy, “Deconstructing the China-Pakistan Economic Corridor: pipe dreams versus geopolitical realities”, Journal of Contemporary China, 2018, 27 (112): 519–533

- Samrez Salik, Muhammad, “China-Pakistan Economic Corridor: A Perspective from Pakistan”, Asian Journal of Middle Eastern and Islamic Studies, 2018, 12 (2): 142–154. doi:10.1080/25765949.2018.1481619. S2CID 158441766.

- Official CPEC website (Government of Pakistan)

Dr. Lakshmi Karlekar is an Assistant Professor at the School of Humanities – Political Science and International Relations, Ramaiah College of Arts, Science and Commerce, Bengaluru. She holds a PhD in International Studies and has consistently ranked at the top during her academic journey at the Department of International Relations, Political Science, and History at CHRIST (Deemed to be) University, Bengaluru. Views expressed are the author’s own.