- Germany is experiencing its longest post-war economic stagnation, with minimal or negative GDP growth since 2019, and continued stagnation is expected in 2025.

- High energy costs, declining exports, and weak manufacturing have severely undermined industrial competitiveness and business investment.

- Structural weaknesses, including an ageing population, low productivity, bureaucratic hurdles, and slow digital and green adoption, exacerbate the economic slowdown.

- Germany’s stagnation threatens Eurozone stability, raising unemployment, suppressing domestic demand, and risking broader regional economic disruption.

Once a dominant, well-tuned Race leader at the head of the pack, it now labours much like an old car experiencing technical issues with newer, quicker competitors leaving it behind. The nation’s economic “engine” that propelled the Eurozone’s expansion is now bogged down in stagnation, bogged under high energy prices and declining manufacturing production, with only distant prospects for an upcoming performance overhaul as public spending and reforms are subject to discussion.

Germany’s economic system lags behind the pace of global changes and internal vulnerabilities. Meanwhile, optimism for a change is pinned on technological overhauls like structural reforms, investment and an expert pit crew (responsive policy), but a podium finish is still out of reach in the meantime.

Stagnation and Deepening Crisis

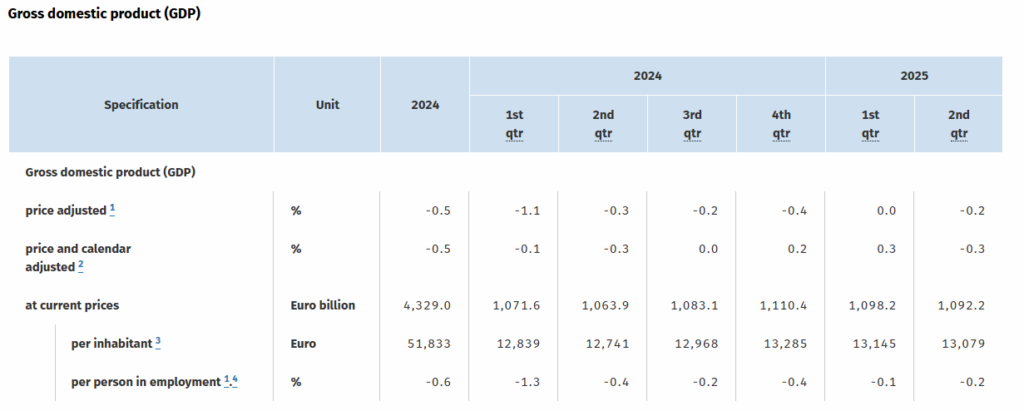

Germany’s economy is experiencing its longest phase of stagnation since the Second World War. Throughout 2024, economic activity was virtually stagnant, unable to top the levels reached in 2019. With 2025 underway, things look bleak: analysts expect either a continued stagnation or, in a worst-case scenario, further shrinkage, a seven-decade-long period of economic stagnation unrivalled in post-war German history.

Official projections confirm this grim path. The federal government, top economic think tanks, and the European Commission all foresee minimal growth uniformly, with projections often revised downward, first from a 0.3% increase to actual stagnation or even a 0.5% decline. In the last two years, Germany has been the sole large EU and G7 economy that hasn’t seen positive GDP growth, an indication of structural issues exceeding transitory cyclical decelerations.

Behind this complacency lies a collapse in investment. A mere 22% of companies intend to make new investments in 2025, whereas almost 40% are scaling back existing ones. Most importantly, the vast majority of the remainder is used to replace ageing plant and machinery as opposed to driving innovation or growth. This risk-averse stance threatens to speed up deindustrialisation, leaving Germany’s previously booming manufacturing industry ever more on the back foot in a competitive world economy.

The combined force of flat output and shrinking investment is establishing a self-sustaining feedback loop: without aggressive investment, growth in productivity stalls, and in turn stifles economic momentum. For policymakers, the dilemma is stark; ending four decades of loss of industrial and technological dominance will call for strong action, otherwise Germany will remain stuck in one of the longest episodes of economic stagnation in post-war European history.

Drivers of Weakness

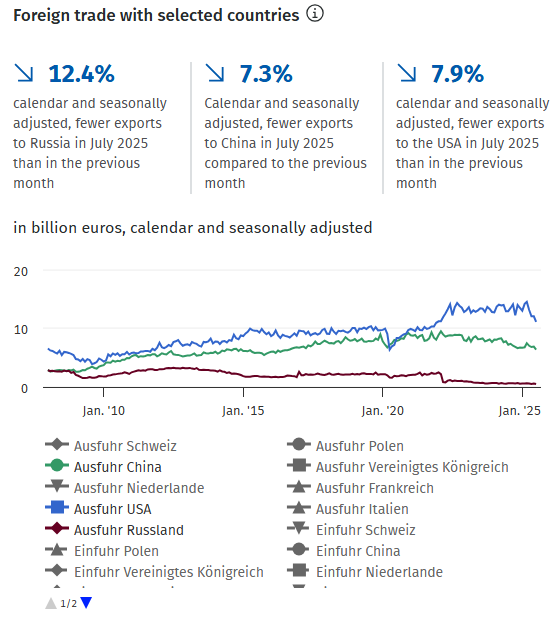

Germany’s economic afflictions are strongly rooted in structural weaknesses that have become progressively worse over recent years, with the manufacturing sector and exports heading the crisis. The very driver of the nation’s prosperity, German manufacturing, today is under extreme pressure. An unexpected drop in overseas demand, coupled with higher protectionism and imposition of US tariffs, has hit exports hard, particularly in energy-intensive industries. What used to be a guaranteed source of expansion has experienced its steepest drops in decades, further allied with shortages of supply and record energy prices compressing margins and pulling competitiveness.

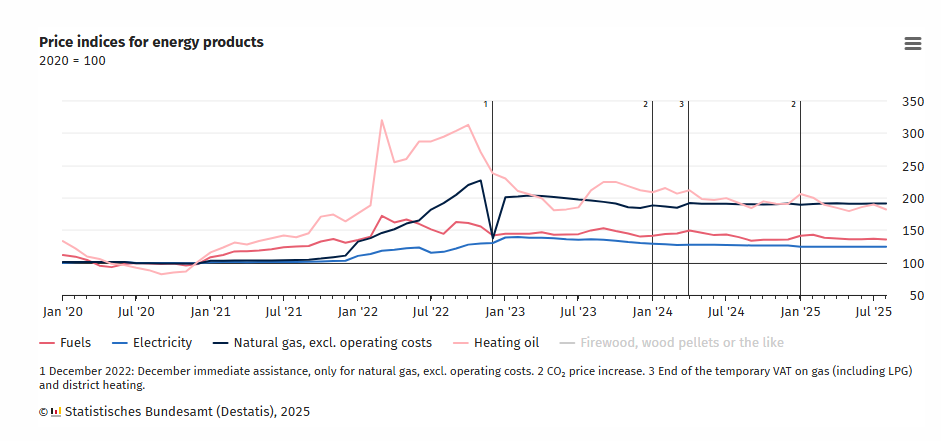

Energy prices continue to be a hot issue. Following the Ukraine conflict and Germany’s rapid exit from Russian gas, national energy prices are now among the highest in the region. For companies already beset by global competition and declining demand, these high prices threaten business viability, forcing companies to cut production or defer new investment.

Political and global uncertainties have added to these economic pressures. Pending elections, unstable coalition governments, and the emergence of political extremes are generating a general sense of insecurity. As well, ongoing global trade tensions erode confidence in foreign markets. In combination, the effect has been a dramatic fall in business and consumer confidence, creating a vicious circle where restraint in spending and investment further sustains stagnation instead of goading recovery.

In such an environment, Germany’s economic vulnerabilities are structural and acute, the product of a confluence of structural, geopolitical, and policy-driven conditions that remain a challenge for Europe’s largest economy.

Broader Eurozone Impact

Germany’s slowdown is now spilling over into the Eurozone. It’s a historical growth driver of the European continent, but it is threatening to emerge as a weak link, straining regional growth, disrupting supply chains, and complicating policy coordination. Structural weaknesses, deteriorating labour productivity, an ageing population, congested bureaucracy, and slow adoption of digital and green technology discouraged competitiveness. Uncertainty over economic and climate policies also discourages investment.

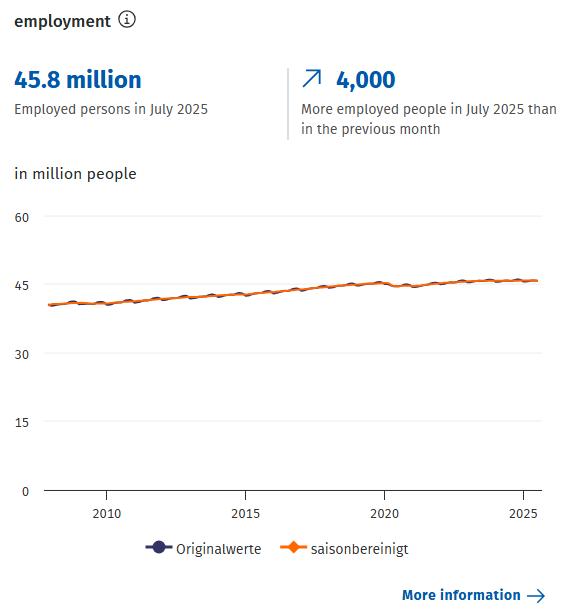

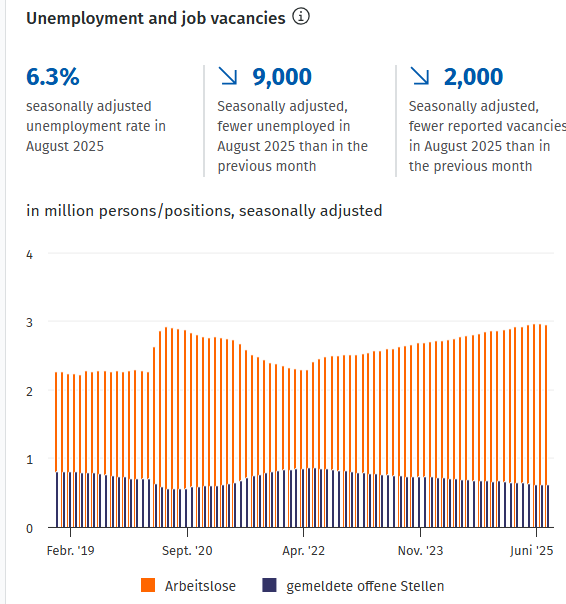

As a result, both households and businesses are feeling the strain, with employment at 45.8 million, unemployment at 3.03 million, and 663,000 reported vacancies. The unemployment rate has risen from 6.0% to over 6.3%, and though it may ease, inflation will also find itself staying above 2% for 2025 and later, eroding real earnings and slowing household demand. Germany’s decline, if left unchecked, also threatens its own turnaround and the stability of the Eurozone in general.

Forecasts and Possibilities

Looking ahead to 2025 and beyond, agreement among top institutions, the Bundesbank, DIHK, the German Council of Economic Experts, and the European Commission, is dismal: no real growth can be achieved. Dull growth can only emerge in 2026, with projections at 0.7% to 1.2%, possibly strengthened by increased government consumption and a shift to quieter global trade tensions.

But the price of inaction is severe. Without drastic structural reform and specific investment, most importantly in green technology and entrepreneurialism, Germany can be exposed to deindustrialisation that threatens to deprive it of its historical function as Europe’s economic anchor.

Experts contend that reversal of the trend will involve rapid policy response: easing bureaucratic barriers, pushing forward with digitalisation, promoting upgrading of skills and innovation, stabilising energy prices, and widening the scope for government investment. These steps are seen as necessary not only to restore competitiveness but also to prevent Germany’s stagnation from spreading to the entire Eurozone.

Germany’s economic hardships today are no longer a cyclical downturn but a policy and structural crisis. Unless bold reform and eminent leadership step in, stagnation will proceed to erode the nation’s economic standing and alter the economic balance of power in Europe for decades ahead.

References:

- https://statistik.arbeitsagentur.de/DE/Navigation/Service/English-Site/the-labour-market/the-labour-market-Nav.html;jsessionid=F2AE85291FA700DE6CCB884E1EC09E47

- https://www.bundesbank.de/en/statistics/economic-activity-and-prices/employment-and-labour-market/employment-and-labour-market-795472

Sidhartha Muraleedharan is a Business Owner, Cross-Border Business Consultant, and Political Observer, residing in Germany for the past 16 years. Views expressed are the author’s own.