- The linking of PayNet to UPI is expected to make the payment for goods and services easier for Malaysians in India and their counterpart doing business in Malaysia to enjoy the enhanced financial experience.

- Given that UPI has been accepted in Malaysia, Indian tourists will be able to make payments when in Malaysia thus increasing the number of visitors.

- With India extending UPI services to Malaysia, it reasserts itself as the leader in digital finance solutions in the Southeast Asian Region.

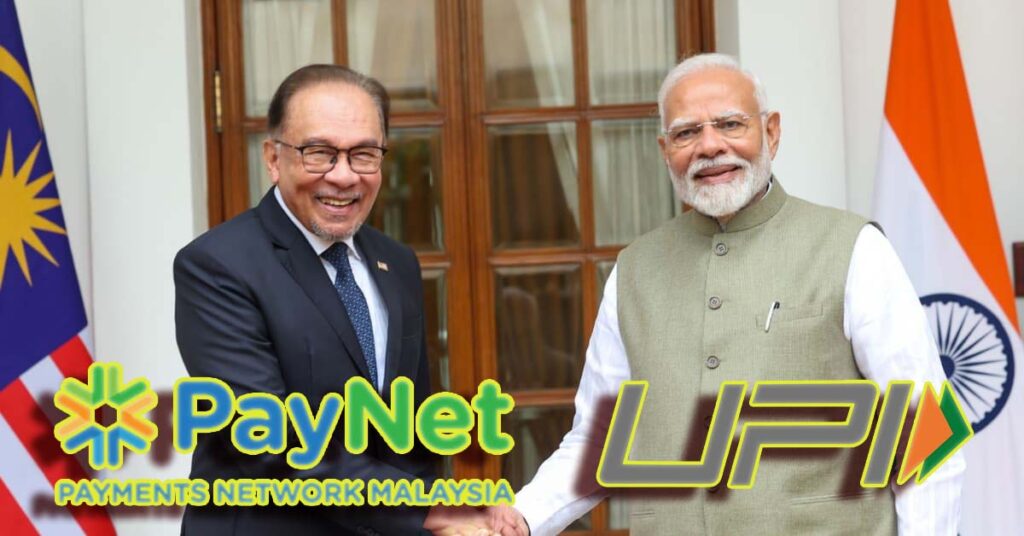

The recent trip by Malaysia’s Prime Minister Anwar Ibrahim to India has gained a boost around digital financial linkages, especially through the linking of Malaysia’s PayNet and India’s UPI. The purpose of the visit is to try to enhance the efficiency and credibility of cross-border payments and strengthen the economic partnership between the two countries.

Strengthening Financial Connectivity

On his visit, Prime Minister, Anwar stated that issues to do with electronic payment systems are crucial in trade and tourism. The linking of PayNet to UPI is expected to make the payment for goods and services easier for Malaysians in India and their counterpart doing business in Malaysia to enjoy the enhanced financial experience. UPI which is an indigenous product which has been developed by NPCI (National Payments Corporation of India) has already been adopted in many countries like Sri Lanka and Mauritius where it has been integrated with other payment systems. This positive model is helpful for Malaysia which is interested in improving the infrastructure of its digital payment services. [1]

Benefits of integrating UPI and PayNet

Seamless Transactions: The target users will have access to both Systems in Malaysia and India and make transactions easily. It will also minimize the use of foreign currencies and therefore help to bring down the cost of the transaction.

Boost to Tourism: Given that UPI (United Payments Interface) has been accepted in Malaysia, Indian tourists will be able to make payments when in Malaysia thus increasing the number of visitors. Likewise, UPI will be convenient for Malaysian tourists when they are in India, so the results are expected to be positive.

Economic Growth: The improvement of the connections in terms of the financial markets should support the overall economic activity, which is favourable for the local players in both countries. The ease of transactions can trigger more forex dealings and investments.[2]

Strategic Implications

This project aligns with the ‘Neighbourhood First Policy’ of India aimed at increasing cooperation with the neighbouring countries through trade and commerce and the application of information technology. With India extending UPI services to Malaysia, it reasserts itself as the leader in digital finance solutions in the Southeast Asian Region. This has not only boosted the social-diplomatic ties between the two countries but also firmly placed India at the strategic node of the digital economy of the world. [3]

Prime Minister Anwar’s’ visit and the meeting on the idea of integrating UPI with PayNet signifies both countries’ willingness to strengthen economic relations through efficient tools. Consumer businesses for enhancing their positions in the technology area as well as trade and tourism sectors are expected from the cooperation.

Linking Malaysia’s PayNet to India’s UPI is a massive step in the interconnectivity of digital finance in Southeast Asia. On the side of the prospective results for the citizens, companies, and overall economy, there is a lot of potential for both nations chasing the establishment of this system. Thus, while this will improve the efficiency of transactions, it will also boost the historical trade relations between the two nations, thus laying the foundation for a future digital relationship in the region.[4]

References:

- [1] India and Sri Lanka working together to link UPI and Lanka Pay: PM Modi-https://economictimes.indiatimes.com/industry/banking/finance/banking/india-and-sri-lanka-working-together-to-link-upi-and-lanka-pay-pm-modi/articleshow/104417986.cms

- [2] Unified Payments Interface (UPI)-https://www.npci.org.in/what-we-do/upi/product-overview

- [3] India’s UPI launched in Sri Lanka, Mauritius; PM Modi says ‘special day-https://www.hindustantimes.com/india-news/indias-upi-launched-in-sri-lanka-mauritius-pm-modi-says-special-day-101707754234890.html

- [4] UPI payment services launched in Sri Lanka, Mauritius; PM Modi describes it as a ‘special day’-https://www.thehindu.com/business/upi-payment-services-launched-in-sri-lanka-mauritius-pm-modi-describes-it-as-special-day/article67837735.ece

Parag Gilada is a Mukherjee Fellow who has recently graduated from the Jindal School of International Affairs with a keen interest in Sports Diplomacy. Views expressed are the author’s own.