- The current fiscal landscape in several Indian states reflects a pressing need for strategic fiscal management.

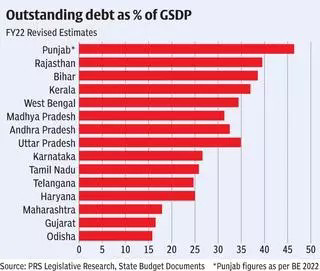

- RBI data underscores the financial challenges faced by states like Punjab, Kerala, Rajasthan, Bihar, and West Bengal, emphasizing the urgency for prudent economic policies.

- Overreliance of the states on borrowed money for day-to-day operations poses a serious threat to responsible financial management, creating a ripple effect on inflationary pressures.

- States must prioritize projects that stimulate economic growth and job creation, reducing reliance on borrowed funds along with a meticulous examination of expenditure patterns.

Introduction

India’s different states are dealing with money problems as many find themselves stuck with a lot of debt compared to what they make. The worries include a growing revenue deficit, too much debt, and improper handling of available resources. This article examines the fiscal issues faced by states like Punjab, Kerala, Rajasthan, West Bengal, and Bihar, explaining why they are in deep debt.

Punjab’s Debt Dilemma

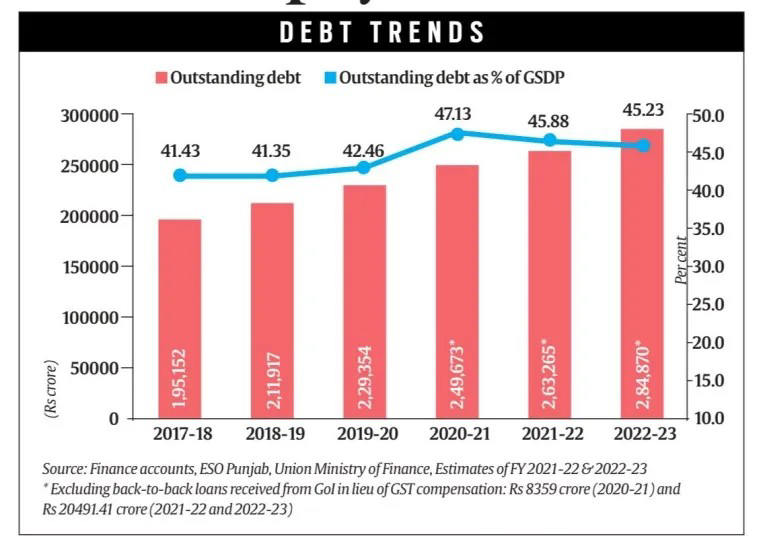

Punjab is grappling with a formidable debt exceeding ₹47,000 crore, signalling a financial predicament that demands immediate attention. Shockingly, a substantial ₹27,000 crore was borrowed solely to service interest on existing obligations. The state’s debt-to-Gross State Domestic Product (GSDP) ratio has surged past 45%, a stark contrast to the recommended 20%, intensifying the financial challenges. The State of State Finances Report for 2023-24 also states that the heavy indebtedness of Punjab is manifesting in substantial interest payments, exerting immense strain on Punjab’s revenue budget.

Punjab’s financial landscape is further complicated by unpaid arrears from the Sixth Pay Commission, exacerbating the fiscal crunch. Insufficient funds for crucial projects amplify the state’s struggles, and the burden is felt acutely as it grapples with managing various freebies.

Reports from the Bank of Baroda’s research further accentuate the severity of Punjab’s financial challenges, emphasizing the urgent need for stringent fiscal monitoring. The state’s debt crisis necessitates a concerted effort towards reducing fiscal deficits and fostering higher GSDP growth. With Punjab standing out with the highest budget size among flagged states, proactive measures are imperative to avert a looming financial catastrophe.

Kerala’s Financial Conundrum

Kerala, renowned for its extensive social programs, faces a formidable challenge as it contends with borrowing limits imposed by the Union government. A significant portion, more than 80%, of the state’s funds is allocated to salaries, pensions, and interest, emphasizing the strain on Kerala’s fiscal resources. The debt-to-Gross State Domestic Product (GSDP) ratio has surged to 39%, surpassing recommended levels and causing considerable concern.

Unlike Punjab, Kerala grapples with late social security payments, raising anxieties about the availability of sufficient funds in the future. This predicament has prompted the state to challenge borrowing restrictions in the Supreme Court, highlighting the urgency of addressing financial constraints.

In contrast to the alarming debt levels seen in Punjab, Kerala’s financial landscape demands nuanced considerations. The State Finance Report for the specified period illuminates Kerala’s unique challenges, emphasizing the need for a delicate balance between sustaining vital social programs and managing fiscal responsibilities. With the debt-to-GSDP ratio exceeding recommended thresholds, the state faces the critical task of navigating a sustainable financial path.

Rajasthan’s Fiscal Challenges

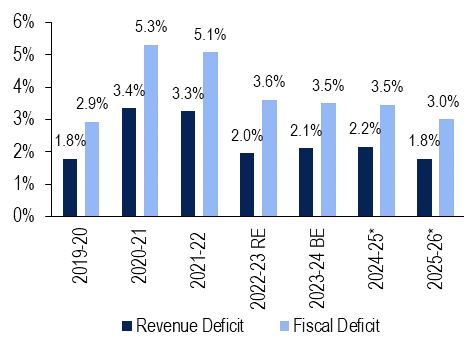

Rajasthan finds itself ensnared in financial stress, grappling with a debt-to-Gross State Domestic Product (GSDP) ratio hovering around 40%, surpassing the threshold considered financially safe. The State of State Finances Report for 2023-24 sheds light on the intricacies of Rajasthan’s economic landscape, unravelling a nuanced narrative of fiscal challenges. The data from the report reveals a concerning fiscal deficit for the year 2024, estimated at 4% compared to the recommended 3%. This substantial fiscal deficit raises alarm bells, potentially exacerbating the state’s financial woes. The heightened fiscal deficit implies that Rajasthan is spending more money than it generates, further intensifying the strain on its economic resources.

The State Finance Report serves as a critical lens through which we understand the unfolding scenario in Rajasthan. As the debt-to-GSDP ratio surpasses the safety benchmark and the fiscal deficit widens, questions arise about the sustainability of the state’s financial policies. The looming uncertainty prompts concerns among the populace, questioning whether Rajasthan’s current monetary trajectory is viable in the long run.

West Bengal’s Erratic Fiscal Management

West Bengal is confronted with a substantial financial challenge, evidenced by a projected debt of Rs six lakh crore by the end of the current financial year and a revenue deficit exceeding Rs 53,000 crore by March-end next year. Data from the State of State Finances Report for 2023-24 provides insights into West Bengal’s fiscal predicament.

1. West Bengal’s outstanding debt burden, which stood at Rs 1.92 thousand crore in 2011, has surged by more than 205% over the last eleven years. The debt-to-Gross State Domestic Product (GSDP) ratio is set to reach alarming levels, raising concerns about the state’s financial sustainability.

2. The state’s revenue deficit is projected to stand at more than Rs 53,000 crore by March-end next year. This escalating deficit poses additional challenges, indicating a strain on West Bengal’s financial resources.

3. West Bengal relies primarily on excise tax and petroleum product levies for revenue generation. As a consuming state, it receives substantial GST returns, sustaining its financial operations.

4. The state plans to raise Rs 73,000 crore from the open market this financial year to service its debt and meet expenses. The significant market borrowings, coupled with a locked-in maturity period of ten years, present a looming financial burden.

5. Despite the catastrophic financial condition, populist welfare measures and cash doles have not been curtailed. Critics argue that West Bengal’s financial situation requires a reevaluation of such expenditures.

6. The state’s failure to attract major investments, coupled with a poor industrial climate, poses impediments to economic growth. The manufacturing sector is struggling, and the MSME sector, despite official assertions, faces dwindling revenue receipts.

7. Experts suggest the need for a sound debt repayment strategy to minimize fresh loans and redirect resources to development projects. Practising frugality, eliminating wasteful expenditures, and exploring new revenue sources are seen as essential steps.

Bihar’s Neverending Economic Challenges

Bihar grapples with a significant economic challenge, characterized by a debt-to-Gross State Domestic Product (GSDP) ratio of 38.7%. This struggle is underscored by the state’s heavy reliance on financial assistance from the central government to sustain its economy. The State of State Finances Report for 2023-24 provides additional insights into the complexities of Bihar’s economic landscape.

1. Debt Burden and Dependency: Bihar’s debt stands at approximately Rs 2.88 lakh crore, illustrating the formidable challenge of generating sufficient revenue internally. The debt-to-GSDP ratio of 38.7% highlights the state’s dependence on external support, especially from the central government.

2. Central Government Assistance: Reports indicate that Bihar heavily depends on financial assistance from the central government to meet its economic needs. The extent of this reliance raises concerns about the state’s self-sufficiency and ability to generate sustainable revenue.

3. Financial Sustainability Challenges: The data from the State of State Finances Report emphasizes the difficulty Bihar faces in generating enough revenue independently. The struggle to balance its financial equation indicates potential challenges in sustaining economic growth without substantial external support.

4. State of State Finance 2023-24: Specifics from the State of State Finances Report highlight Bihar’s financial predicament, shedding light on the intricacies of its revenue generation and expenditure. The report likely reveals patterns of financial allocation, showcasing areas where Bihar faces hurdles in achieving fiscal balance.

5. Impact on Development Initiatives: Heavy reliance on external support may impact Bihar’s capacity to invest in crucial development initiatives independently. The state’s financial dependencies might be constrained by its ability to fund projects, address socioeconomic challenges, and foster growth.

6. Strategic Measures Needed: The economic scenario suggests the necessity for Bihar to adopt strategic measures to enhance revenue generation. A focus on reducing dependency and fostering self-sufficiency becomes imperative for the state’s economic resilience.

These states face similar challenges, with a lot of money spent on helping electricity distribution companies (DISCOMs). A big chunk of losses faced by these companies in all of India is concentrated in these five states. To cut these losses, prices often need to go up, adding to inflation worries.

The Need for Smart Money Management

The current fiscal landscape in several Indian states reflects a pressing need for strategic fiscal management. Recent data from the Reserve Bank of India (RBI) underscores the financial challenges faced by these states, emphasizing the urgency for prudent economic policies.

One notable concern is the disproportionate allocation of funds, with a substantial portion directed towards recurrent expenditures like salaries and subsidies. This overreliance on borrowed money for day-to-day operations seriously threatens responsible financial management, creating a ripple effect on inflationary pressures.

Analyzing recent economic trends, it becomes evident that a considerable share of these states’ budgets is not allocated towards development and infrastructure, key drivers of sustainable economic growth. This imbalance raises questions about the state’s long-term economic resilience.

To address these challenges, a comprehensive approach is required. States must prioritize development projects that stimulate economic growth and job creation, thereby reducing reliance on borrowed funds. Furthermore, a meticulous examination of current expenditure patterns is imperative, focusing on optimizing budgetary allocations for essential services while curbing unnecessary expenses.

Recent policy shifts in successful states could serve as models for these struggling regions. Emphasizing smart money management involves adopting innovative financial strategies, such as public-private partnerships, to fund critical projects without overburdening state coffers. This approach not only attracts private investment but also ensures that developmental initiatives are sustainable in the long run.

(Aayush is a post-graduate student in International Relations at Kalinga University, Raipur. Umesh is a geopolitical and global economic analyst. Views and opinions expressed are the author’s own)